Labour market

Improvements in US consumer expectations halt in July

Households more pessimistic as Covid-19 continues to spread, New York Fed survey reveals

BoE says negative rates ‘in toolbox’ and forecasts slow recovery

First “proper” forecast since Covid-19 outbreak gives little hope of a V-shaped recovery

Labour market situation is ‘complicated’ – RBA’s Lowe

Unemployment likely to worsen despite initial signs of recovery, governor says

Singapore faces most severe downturn since independence – Menon

Singapore’s economic situation remains “dire” and activity will be below pre-crisis levels “for quite a while”

Brainard urges caution about US recovery

Bounce in activity came earlier than expected but major risks still loom, Fed board member says

US citizens think Fed’s communication strategy needs adapting – Fed report

“Fed Listens” events revealed a lack of understanding about inflation targeting, report shows

Recession causes inequality ‘double whammy’ – research

Paper links loss of hours worked to inequality, with recessions causing a negative ratchet effect

Fed promises to keep buying assets at current rate

Fed will hold accommodation in place for “however long it takes”, chair Jerome Powell says; FOMC releases first projections this year

Record hiring needed to reach pre-crisis unemployment by end-2021 – paper

Hiring four times faster than most robust pace in Great Recession still not enough, researchers find

Economists challenge standard notion of labour market recovery

Paper on post-crisis recoveries questions demand shortfall narrative

Lower-income households feel worst of Covid-19 economic shock – Fed survey

Nearly 40% of low-earning households faced at least one job loss in March, survey finds

Economists race to merge epidemiology and macro

Promising results are emerging, but workable forecasts may be some way off

Scale of Covid-19 impact shows up starkly in US stats

All of the US’s key macroeconomic indicators point to a dramatic slump

Fed set to adopt ‘elements’ of price-level targeting

Covid-19 could act as a catalyst for a Janet Yellen-supported Fed move to adopt elements of price-level targeting. But questions remain about the timing of such a move

ECB research finds Phillips curve still matters

Underlying relations are complicated, but slack and expectations still drive prices, economists say

Pandemics can depress natural rates for multiple decades – SF Fed

Real wages tend to rise gradually for 30 years after pandemics, data stretching back to 1340s shows

Women affected more by job losses in US lockdown – Kansas Fed

Roughly 60% of job losses were to women in the first half of March, researchers find

Covid-19 macro effects could last 40 years – research

Research from University of California says natural rate could take decades to return to normal

16% of US jobs in high-risk sectors – Brookings research

Researchers examine possible impact of coronavirus on US sectors and metropolitan areas

US economy could face largest quarterly contraction in history – Bullard

$2.5 trillion in national income might be wiped out, St Louis Fed president says; Congressional leaders agree $2 trillion stimulus package

US health system likely to be overwhelmed – Minneapolis Fed paper

Policy-makers must support massive healthcare investment and severe social distancing – researcher

Do low rates spur investment?

Many believe low interest rates spur investment, but there appears to be little hard evidence to support such claims, writes former IMF head Jacques de Larosière

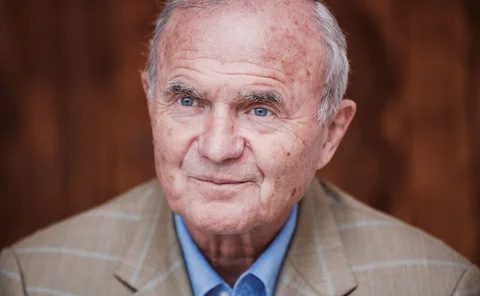

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

Fed leaves monetary stance unchanged but tweaks IOER

FOMC also announces updated plans on its balance sheet and repo market interventions