Basel III

Federal Reserve adopts Basel III for US banks

Fed Board unanimously votes to introduce new capital requirements as of January 1; Daniel Tarullo says additional measures will follow including proposals for a higher leverage ratio

Basel leverage ratio would double up collateralised OTC positions

Ratio could be a 'game-changer', dealers warn, as Basel Committee proposes counting received collateral as well as derivatives exposures

Basel Committee reveals leverage ratio formula

Proposals detail leverage ratio calculation framework and disclosure requirements that will enter force in 2015; committee keeps options open for a higher leverage ratio than originally planned

Switzerland passes Basel III implementation test

Assessment finds country ‘compliant’ overall with Basel III capital framework, although a number of regulations had to be tweaked to make the grade

Belgian supervisor warns against Basel III over-simplification

National Bank of Belgium’s Rudi Bonte calls for the Basel Committee to take a ‘moderate’ stance on the trade-off between simplicity and complexity in its risk and capital rules

Fed's Plosser calls for a move to simple, but higher, capital requirements

Philadelphia Fed president says there is no better example of over-complex rule writing than risk-weighted capital calculations - and calls for a shift to simpler rules which are harder to evade

Basel securitisation reform creates 'perverse incentives’, says senior Japanese banker

Inconsistent rules are damaging financial intermediation, according to Takashi Oyama of Norinchukin Bank

Fed’s Raskin warns of shortcomings in leverage ratio

Sarah Bloom Raskin says a leverage ratio can guard against the failings of risk-weighted capital requirements, but cautions that the ratio has issues of its own

Fed’s Yellen moots higher capital requirements for US banks

Janet Yellen says Basel III capital requirements may not be enough to end the too-big-to-fail problem; sizes up risk in the shadow-banking sector

IMF ‘policy book' tackles Mena central bank challenges

IMF's monetary and capital markets department analyses operational frameworks of Mena central banks, and obstacles to monetary policy; urges Basel III adoption

Banks push alternative to Basel Committee securitisation model

Basel proposals would kill European market, banks warn – and some regulators sympathise

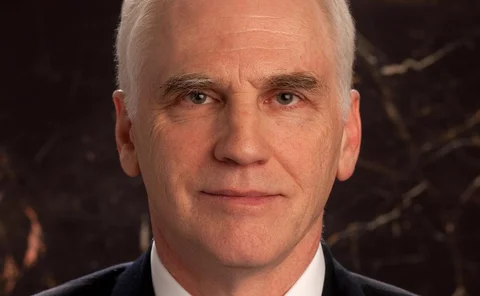

FDIC’s Thomas Hoenig on bank separation, safety nets and Basel III

Hoenig tells Christopher Jeffery that Basel III is flawed, universal banks require legal separation, financial safety nets need cutting and monetary policy should move to non-zero interest rates

Fed’s Tarullo says wholesale funding is the most important gap in regulation

Fed governor warns regulation does not yet adequately address vulnerabilities in the financial system, citing wholesale funding and ending too-big-to-fail as particular problems

FDIC’s Hoenig blasts Basel III risk weights as insufficient

Thomas Hoenig argues that Basel III can be ‘gamed' and that the capital ratios may over-represent the actual state of banks’ balance sheets

Bank of Japan raises ‘major concerns' over US foreign bank rules

Letter to Fed governor challenges proposed regulation of foreign banks on the basis of inconsistency with international standards and restrictive liquidity rules; Germans also weigh in

Banks to blame for regulatory fragmentation, says Basel Committee’s Coen

Bank lobbying has encouraged national supervisors to water down global standards, says deputy secretary-general of Basel Committee

Fed’s Stein backs ‘committed liquidity facility’ as supplement to Basel LCR

Federal Reserve governor says facility approved for use in Australia could be a good way of maintaining liquidity during crisis and imposing a ‘pollution tax’ on illiquid banks

BIS committee hails Basel III progress

In report to G-20, the Basel committee says member countries are making ‘considerable progress’ implementing Basel III, despite long delays; laments ‘excessive’ variation in RWAs

Haldane issues call to arms in fight against regulatory complexity

Bank of England executive director warns incremental approach to regulation papers over cracks and leads to a burdensome, ineffectual patchwork of rules

FDIC vice-chair says Basel III capital requirements provide illusion of safety

Thomas Hoenig says capital ratios allow banks to leverage up while outwardly appearing safe; warns systemically important banks have much worse leverage ratios than smaller institutions

Asia corporates unfairly ‘penalised’ by CVA capital charge

The move by European authorities to exempt European banks from holding CVA capital should be matched by regulators in Asia, according to senior bankers in the region

Kazakh banks should go beyond Basel III, says central bank

Financial stability report calls for banks to boost capital levels above Basel III requirements; encourages largest banks to clean up balance sheets and lend more

Basel III insufficient for ‘huge’ Swedish banking system, says Ingves

Sveriges Riksbank governor says Sweden must go ‘over and above’ capital and liquidity standards in Basel III; identifies household debt and bank market-funding as core weaknesses

BIS finds Singapore compliant with Basel III

Consistency assessment finds Singapore compliant in 12 areas and ‘largely compliant’ in remaining two; report notes 46 deviations were initially identified, but many were addressed during the review