Basel III

Basel Committee proposes scrapping VAR

Review recommends switch to expected shortfall, postpones CVA charge overhaul, and retains split between banking and trading books

FSA’s Turner outlines reforms needed in eurozone

Adair Turner sets out reforms necessary for eurozone stability; calls for creation of euro bonds and greater fiscal integration

Sarb revises growth forecasts upwards for 2012

South African Reserve Bank publishes Financial Stability Review; revises growth estimate upwards

Video: Bank of Mexico’s Duclaud says new rules will hit sterilisation costs

Javier Duclaud explains Mexico’s problems in 2008, why the country has increased reserves by $70 billion and how Dodd-Frank and Basel III are causing sterilisation problems for central banks

Interests of investors and supervisors are aligned by Basel reforms, says BIS chief

Bank for International Settlements general manager believes Basel reforms pose no long-term conflict of interest between bank shareholders and supervisors

Countries named and shamed over Basel regulation delays

Basel Committee releases progress update on regulation implementation; highlights slow progress in some countries

New Zealand proposes partial earlier adoption of Basel III capital requirements

New Zealand regulators have opted to bring in the capital conservation and countercyclical buffers ahead of the Basel Committee schedule – but market participants are unsure if this is necessary

Thai governor says Basel III guidelines imminent

Prasarn Trairatvorakul says first draft of the Basel III capital regulatory framework and liquidity risk management guidelines to be introduced 'later this month'

ECB compromise on Basel III adjustments gets mixed response

An ECB proposal for the European Systemic Risk Board to have oversight on whether European regulators can adjust Basel III for macro-prudential purposes gets a mixed response from central bankers

Cœuré gives ECB perspective on priorities for the reform of financial regulation

Newest member of the European Central Bank's executive board talks about the key issues financial regulatory reforms must address

New CRD IV draft exempts sovereign trades from CVA capital charge

The latest council draft adds a CVA capital charge exemption for sovereign derivatives transactions – potentially removing one of the big unintended consequences of CRD IV, participants say

Swedish authorities lambast maximum harmonisation for Basel III

Swedish Finansinspektionen and the Riksbank hold first joint meeting on macroprudential policy matters; again take on EU proposals to fix capital adequacy requirements

Basel DVA capital deduction could cost banks billions

Billions of dollars in capital could be excluded under Basel proposals on derivatives DVA - with US banks hardest hit

IMF paper captures spillover effects from tougher capital rules

Fund study shows international spillover effect from higher capital requirements typically account for 20-25% of the total impact on output

Governor of the Central Bank of the Philippines talks Basel III

Amando Tetangco explains how Basel III has a “perverse” impact on countries with strong fiscal discipline and why the Sifi designation is less important than rigorous regulation

Bundesbank’s Dombret calls for rigorous monitoring of Basel III implementation

Bundesbank executive board member Andreas Dombret says financial market's attempts to create global level playing field for regulation should face scrutiny

Ingves targets domestic Sifis with tougher capital rules

Basel Committee chairman Stefan Ingves says all institutions whose disorderly distress or failure could trigger a systemic crisis should be subject to additional capital requirements

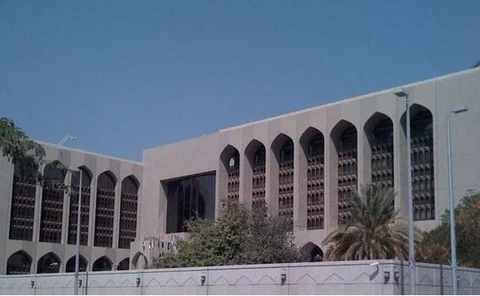

FSB Regional Consultative Group meetings continue

Middle East and North Africa consultative group is latest regional FSB body to meet; discussed financial vulnerabilities of the region

IMF models new liquidity stress test framework

International Monetary Fund study creates new template to conduct balance sheet-based liquidity stress tests

Basel implementation monitoring strategy approved

Basel Committee governing body agrees plans to monitor member countries' efforts to implement new rules; also discusses liquidity coverage ratio

Basel statement on risk transfer could halt legitimate trades, bankers warn

Basel Committee’s focus on cost of credit protection in attempt to stamp out capital arbitrage could also hurt sound trade trades, investment banks claim

FSB consultative group for the Americas gathers in Mexico

Central bank governors Agustín Carstens and José De Gregorio co-chair first regional group meeting to exchange views on key financial stability issues

FSA’s Bailey calls on banks to plan for eurozone break-up

Banks must prepare for the "disorderly departure of some countries from the eurozone", says Andrew Bailey

Sweden sets higher capital buffers for big banks

Swedish authorities say capital buffers of country’s largest banks will be raised to 10% of risk-weighted assets by 2013, swelling to 12% in 2015