Basel III

Bundesbank's Lautenschläger raises leverage ratio concerns

Introducing the leverage ratio as the primary regulatory requirement would mean taking two steps back to the risk-insensitivity of Basel I and even beyond, Bundesbank deputy president argues

RBA’s Ellis warns against regulatory ‘monoculture’

Reserve Bank of Australia’s financial stability head says regulatory consistency is ‘important’ but should not result in identical business models that could all be vulnerable to one particular shock

China relaxes liquidity rules to fall in with Basel timeline

New approach to liquidity risk intended to reduce the regulation's pro-cyclicality; new rules come into effect on January 1, 2014

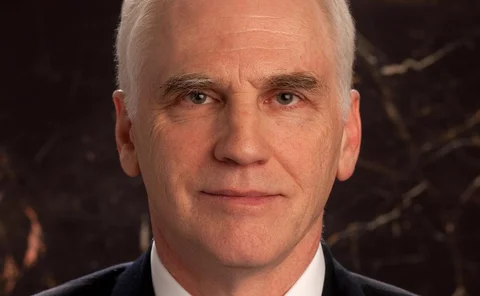

UBS and Credit Suisse still pose risks to financial stability, SNB vice-chair says

Jean-Pierre Danthine argues Basel III is inadequate and does not rule out possibility of future public bail-outs; warns Switzerland's biggest banks still 'very large by international standards'

Central Bank of Ireland diverges from Basel III on AFS bonds

Irish bank capital numbers would filter out unrealised gains and losses on government bonds

Basel III requirements could clash with new bail-in rules, warns IMF

Increased pressure on banks to rely more heavily on collateralised debt could combine with ‘depositor preference' rules to raise funding costs at a time when credit conditions remain tight

Chinese capital rules meet Basel III standards

Bank for International Settlements report says China’s capital rules are in line with the Basel III minimum standards, but finds two 'potentially material' flaws

Ingves addresses Basel 25th anniversary audience

Riksbank governor and Basel committee chair highlights five developments over the past quarter of a century, including a shift from a micro- to a macro-prudential perspective

Basel update shows biggest banks' CET1 position improving

Latest periodical review of progress towards Basel III standards shows the world's biggest banks are closing the gap on core Tier I capital requirements; US issues guidelines for Basel compliance

MAS's Menon says Basel rules could hit infrastructure finance

Basel III regulations could disincentivise long-term lending, particularly to private-sector projects, warns Monetary Authority of Singapore managing director Ravi Menon

FDIC chair discusses US effort to balance capital and leverage requirements

Martin Gruenberg says Basel III relies too heavily on capital ratios, potentially incentivising big banks to employ ‘imprudent' leverage strategies; discusses regulatory remedies

Scandinavians open macro-pru toolbox to cool overheated housing markets

Rising property prices, increasing household debt and towering banking sectors are pushing Norway, Sweden, and Denmark to consider unconventional measures to pre-empt a crash

Bank of England publishes banking primer to educate public

Article says role of prudential regulation is to ensure the soundness of banks by ensuring they have sufficient capital and liquidity to avoid disruption of critical services provided to the economy

Basel's Byres says 'single global rulebook' wouldn't work

Different jurisdictions require different financial rules, according to the secretary general of the Basel Committee on Banking Supervision, but efforts should be made to standardise risk weighting

Pakistan adds Basel III capital surcharge to allow for modelling shortfalls

State Bank of Pakistan outlines its Basel III capital requirements for domestic banks

Czech governor slams one-size-fits-all regulation

CNB workshop considers impact of Basel III on emerging and smaller economies; participants consider the unintended consequences of both capital and liquidity rules

BIS sizes up derivatives reforms and Basel III progress

Bank for International Settlements releases one report on the expected benefits and costs of OTC derivative reforms, and another on countries’ progress in implementing Basel III

RBA to provide A$300 billion for committed liquidity facility

RBA contribution will ‘not materially impact' its balance sheet, says deputy Debelle; banks will pay a penalty rate to access the CLF, which will help them meet Basel III liquidity requirements

Sarb issues new collateral requirements for committed liquidity facility

While revisions to Basel III have reduced South African banks' immediate LCR shortfall, they are still 140 billion rand short, according to the central bank

Fed’s Tarullo hints at global interest in 6% leverage ratio

Daniel Tarullo says the US leverage ratio must be increased to ensure it effectively supports risk-based capital measures; proposal has generated interest from regulators abroad

Fed and FDIC agree 6% leverage ratio for US Sifis

Banking agencies announce rules to increase organisations' leverage ratios; measures remain controversial with the banking lobby and regulators, notably FDIC's Hoenig

Basel Committee finds ‘considerable variation' in bank risk-weights

Variation in bank risk-weights 'driven by diversity in bank and supervisory practices', says Basel Committee as it also moves to strengthen oversight of investments in equity funds

FX clearing driven by capital and collateral costs rather than mandate

As mandatory NDF clearing has been delayed, the likely increase in capital and collateral requirements for FX trades is forcing some to consider clearing ahead of the mandate

No CVA exemptions in US Basel III rules

Europe isolated as US regulators opt for broad counterparty risk charge