How derivatives can add value to modern reserve management

Giorgi Laliashvili, Nikoloz Totladze, Giorgi Tsaia and Tamar Gabaidze

Trends in reserve management 2021: survey results

Reserve management in China: foreign reserves, renminbi internationalisation and beyond

Emerging market debt during interest rate increase cycles: analysis for reserve managers

Interview: Jarno Ilves

How the Fed’s Fima addressed the 2020 dollar liquidity shortage

How derivatives can add value to modern reserve management

In 2021, with investors desperate for positive returns, it is even more difficult for central banks, by definition conservative investors, to find new investments opportunities that would improve their yields without deviating much from their core principles of safety, liquidity and return. Increasingly, they have explored uncharted territories and pushed the boundaries by adopting new instruments or entering new markets – instruments and markets that central banks would have shied away from a decade ago. The responsibilities of reserve managers have become ever more complex in today’s environment, and hence more interesting and exciting.

Among market practitioners, portfolio managers increasingly use options to boost income. However, to conservative investors such as central banks, these types of instruments sound mysterious and highly risky for inclusion in their investable universe. Indeed, derivatives trading does not come without risk – options traded without understanding how to structure a trade, or even how options in general work, can result in positions being taken that are over-leveraged or incredibly risk-laden. On the other hand, when used properly, such strategies can help investors boost income and even mitigate the risk from other instruments.

Where these daring decisions prove to be successful, they bring new opportunities for the rest of the central banking community. Hence, it is valuable to share our experiences and, while investment decisions and strategies have traditionally been hidden by reserves managers, we think it is time to pull back the curtain on certain aspects.

This chapter begins by making the case for central banks to consider options, even when they are not blessed with excess reserves. From there, it outlines some simple but effective option strategies that a reserve manager could consider, along with the type of risk management and analysis necessary for using them. A final section offers some concluding thoughts.

Derivatives supporting traditional fixed income investing

Central banks have traditionally invested in fixed income. As a result, interest rates and yield curve movements have been their major focus. Views about interest rate movements and the future shape of the yield curve have therefore affected investment decisions. These views have been reflected in shorter or longer duration products/portfolios, and/or specific positioning alongside the yield curve. Typically, such investments have been in plain bonds, or interest rate and bond futures.

Derivatives are a nice addition to the investment toolkit as they have allowed reserve managers at the National Bank of Georgia to hedge our exposure in plain interest rate products such as bonds against adverse changes in interest rates. They also mean we can take greater positions in bonds and remain within duration limits.

Furthermore, derivatives have a number of attractive features, especially for those central banks where reserves are not well above the “excess” line. When looking for extra return, countries with large excess reserves often turn their attention to equities, emerging market bonds and currencies, corporate bonds or commodities. In contrast, those with smaller reserves usually cannot afford to allocate to such risky, but potentially high yielding, investments. Here, derivatives offer a great alternative: by committing little capital, one can take significant exposure and benefit from market movements.

Indeed, while we currently manage a small part of the portfolio using options, the experience has helped us manage the entire portfolio better. As the two markets, derivatives and the underlying, are closely connected, a lot of investors prefer to operate mainly (or even solely) on the derivatives side. The derivatives market is usually larger than its underlying instrument market, and hence by understanding how the derivatives segment works we can achieve a better understanding of the underlying market.

As a final point here, it is widely acknowledged that traders need to do exciting things to stay motivated and abreast of latest developments in international markets. Executing derivatives, and in particular options, is a good way of keeping excitement on the trading floor!

Options gaining in popularity

The number of central banks that use options is growing. The Chicago Mercantile Exchange (CME) reports that, out of the 51 central banks involved in its Central Bank Incentive Program (CBIP), 12 use options. This number was zero only seven years ago, and six out of 45 central banks a couple of years ago. Options have therefore grown in popularity. However, not all options are created equal, and not all are acceptable for central banks given their risk appetite.

At the National Bank of Georgia, we have the view that only specific types of options are suitable for central bank reserves. Traditionally, central banks have followed the three core principles of safety, liquidity and returns. Although when trading options we should not deviate from these principles, exchange-traded products were approved for us to use. With these counterparty default risk is minimal, the terms of the contracts are standardised and public, and, finally, everything is transparent, including prices. This last point means that mispricing risks are minimal too. Pricing options might be a challenge in the case of over-the-counter (OTC) products, but exchange-traded options are also liquid and hence meet the second criteria as well. Finally, they present a good opportunity to improve returns – with minimal capital investment earnings may reach double digits on an annual basis.

Another important feature is that these are options on interest rate futures. Interest rate options are part of a trading strategy of betting on the direction interest rates will move in either the short term or long term. Interest rate options are a type of derivative that is based on the value of interest rates, and are generally tied to interest rate products such as Treasury notes. Therefore, the underlying assets are interest rates, so as a reserve manager you will still be focusing on interest rate and yield curve developments. You will continue to watch those macro figures that move the rates in certain directions, and will still have to come up with a view of how the yield curve is going to be shaped in the future.

The main difference is that you have a new and more sophisticated way of expressing your views. With plain bonds or bank deposits, the opportunities for positioning your portfolio against the benchmark are limited. Introducing futures into the portfolio expands your capabilities, and adding options expands those capabilities even further. With options you can express your views and build investment strategies that are not otherwise possible.

For instance, trading options on Eurodollar futures in a fixed income portfolio is a very flexible way to express views on the three-month Libor forward yield curve. Unlike futures, which can be used for directional trades and hedging, options can also be used to bet on specific possible changes in the underling instrument price, yield spreads, on a specific time, change in the volatility of interest rates, and so on.

Another attraction that traders might find in options trading compared to other instruments is that it gives the optionality to make bets on high or low underlying price deviations, together with the direction of the price movement. Generally, high price deviation of the underlying will be helpful with some long and some short strategies: long call/put, long straddles/strangles and short butterfly, short condor strategies, etc. The option value will increase as the price deviation of the underlying increases, which will in turn benefit the above-mentioned strategies. On the other hand, if low volatility is expected, similar contracts with opposite buy/sell sides should be applied to gain benefit from the strategies.

When are options deployed best? In the low-yield environment of 2021, they are a good tool for enhancing returns. In low probability/high impact situations, they may provide a good and cheap hedge. During low volatility periods, selling options might be an effective way of collecting premium. Additionally, options traders should be aware of the time decay, which can work both for and against a trader depending on the circumstances. For instance, in case of a long straddle, as each day passes the value of the option erodes.

Investment strategies using options

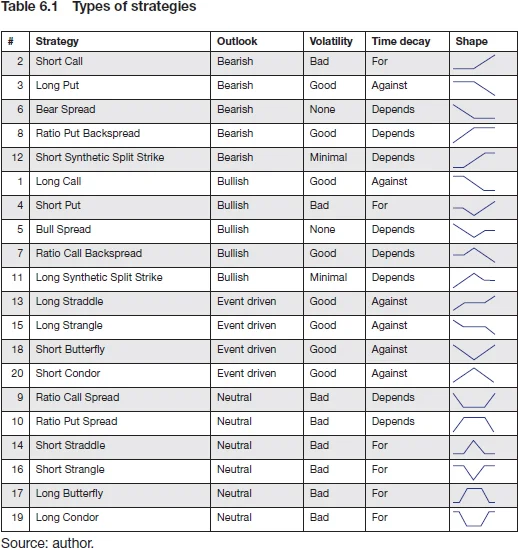

Of course, there are numerous ways to construct most strategies (see Table 6.1). These strategies are generally comprised of two, three or multiple options traded as a combination, meaning that all legs are traded at the same time. They can be traded over time to best suit a trader’s view. Speaking of traders’ views, options strategies can be grouped by outlook (bullish/ bearish/neutral), underlying price deviation expectation, and how time decay affects each strategy within a certain group. If a trader’s view is bullish, these strategies should be used: long call; short put; bull spread; ratio call backspread; and long synthetic split strike. Where a trader’s view is bearish, strategies that can align with that view are: short call; long put; bear spread; ratio put backspread; and short synthetic split strike. If the outlook is neutral (ie, neither bullish nor bearish), there are several interesting strategies that usually aim to collect the premium, but which are the riskiest approach as they are bets on very low price fluctuations of the underlying instrument. If price deviation increases, strategies turn extremely unprofitable. Furthermore, if strategies have legs with unlimited losses, these can turn into a disaster – such losses can be limitless.

Since introducing Eurodollar options into our portfolios, we have effectively utilised these features. However, as the details of option valuation theories are beyond the scope of this chapter, we will instead provide examples of several option strategies.

The National Bank of Georgia’s journey through the range of novel (and, to be honest, previously unimaginable/unreachable) instruments that make up the universe of options began with the construction of a paper portfolio. In this approach, traders would test out all the theoretical knowledge they had acquired. Simulated trades in the paper portfolio helped them gain more confidence and acquire skills, and to learn about small important nuances they would not otherwise have understood.

First and simplest strategies

After the traders had gained confidence trading in the paper portfolios and were ready to dive into live strategies, we went for the simplest of strategies first. These strategies, usually utilised by risk-concerned investors, were simple naked puts that acted as an insurance to protect a profitable position against a drop in their market values (ie, interest rate hikes). Although these are the simplest, all the short positions could theoretically incur unlimited losses (see Figure 6.1). The amount of losses depends how much the rates will drop or rise and, additionally, the more interest rates move in the undesired area, the more the duration of the option increases and the more sensitive the option contract becomes to further rate changes. This feature of option contracts no doubt explains the careful attitude of central banks towards these instruments.

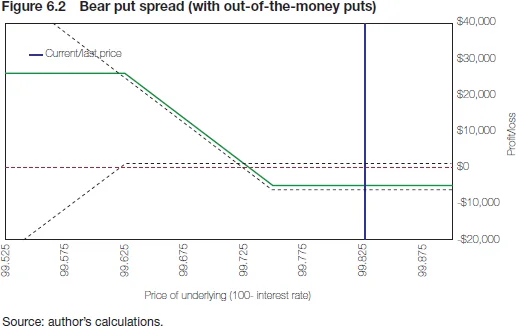

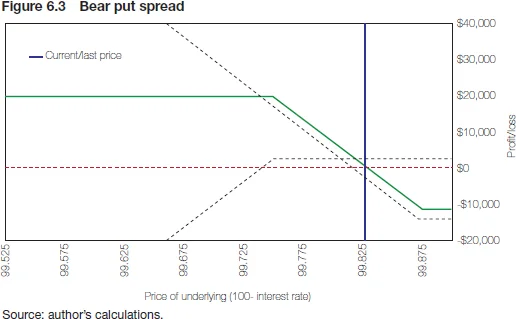

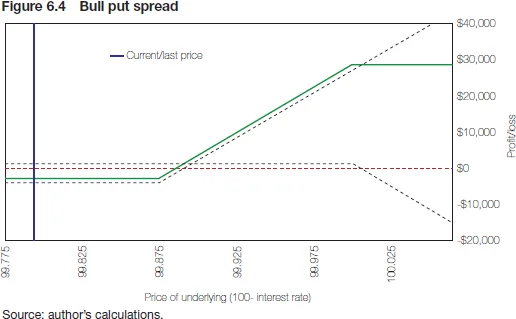

The next move was to use option spread strategies, which are designed to profit from a moderate rise or fall (bull or bear) in an underling asset price (see Figures 6.2–6.6). Spreads are constructed by buying and selling equal numbers of either calls or puts. Both puts and calls have same underling contract, number of contracts and expiration date, but different strike prices. In this way, both profit and loss are limited. In Figure 6.2, put spreads consisting of a long put with a higher price and a short put with a lower strike price are shown.

Most of the spread strategies made by the National Bank of Georgia’s portfolio managers in the early stages of introducing options into our portfolios involved options that expired in less than two years, including mid-carve options. The profit/loss ratio at expiration for these was somewhere between one-and-a-half and three times. The greater the ratio of maximum profit versus maximum loss, the less costly the trade but more out-of-the-money the options become, meaning it is less probable the strategy will become profitable. It is worth noting that if the trader has several strategies constructed in this way with different strike prices and expiration dates but of similar size, and if only half of them succeed, the overall performance will be positive. Sizing of these strategies depends how confident the portfolio manager is in the forward views, and how comfortable they are to accept the possible loss, or how substantial the profit can be given the size of the portfolio.

After constructing the potential strategies, they are checked for conditional value-at-risk (CVaR) and the expected profitability distribution, with the details then entered into the in-house options monitoring file. In many cases, a ten basis point increase in yield would make the strategy considerably profitable. Daily monitoring is therefore essential, as options may go in an opposite direction and bear losses. Also, a portfolio manager’s view may change and they may want to close trades.

Another application for spread strategies are so-called “risk reversal strategies”. These are utilised when a manager has expressed certain views about interest rates already in the portfolio, but there is increased probability that a reverse movement of the interest rate may occur. It is cheaper to hedge this risk with spread strategy than with a naked call option. Sometimes, the cost of this insurance is very close to zero, which means a manager can execute in large amounts and so secure enough profit to recover some of losses in the original strategies, including in cash bonds. In the pre-Covid-19 era, holding a bull spread would be considered unusual at first glance, but turned out to be very profitable as the pandemic crisis deepened and interest rates dropped in the first half of 2020.

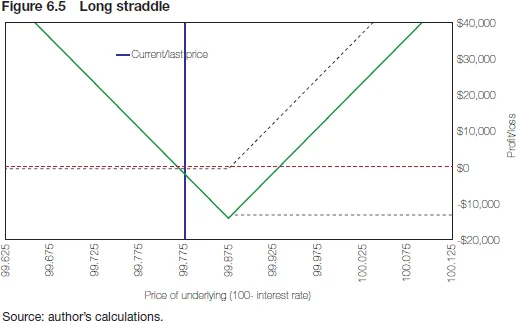

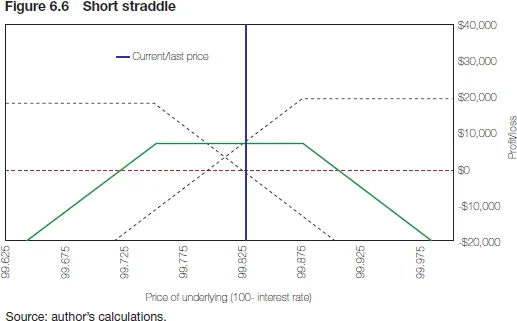

If portfolio manager has a view that for some period of time the underlying’s price will move (irrespective of what direction) or, vice versa, that it will not change, one can build strategies with puts and calls to express those views. In the first case, a “long straddle” (see Figure 6.5) or a “strangle” (see Figure 6.6) does the job, while for the second case, a “short straddle” or “strangle” may accomplish the goal. It is remarkable that for the long ones there is an unlimited profit opportunity from both sides. On the other hand, the short ones may easily move to undesirable area and this may happen a very short period of time.

Moving to more complex strategies: curve trades

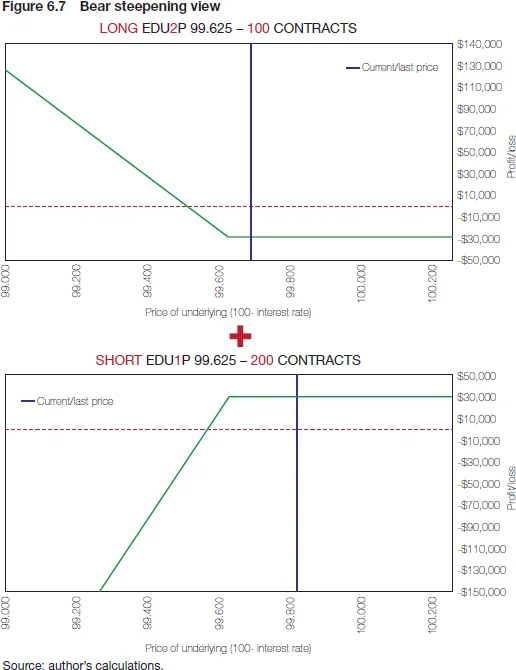

The chapter now turns to somewhat more complex strategies. Interest rate options give the possibility to bet on yield curve movements, including bull steep/flatten and bear steep/flatten by buying or selling options with different underlying contracts (see Figure 6.7). For example, say a trader has a bear steepening view, and buys a put for a longer maturity (say, EDU3) option and sells a put for a shorter maturity (EDU2) option,11 “EDU3” is the CME-Eurodollar futures contract expiring September 2023; EDU2 expires September 2020. all out-of-money and of corresponding weights, so that the paid and received net premiums cancel each other out (trying to avoid paying net premium).

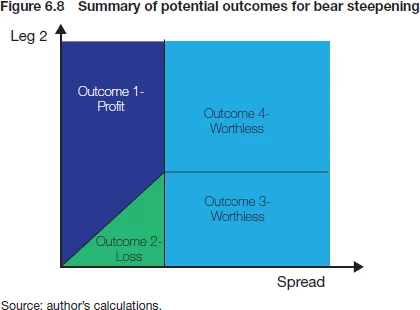

This strategy has four potential outcomes: (i) profits if the view was correct; (ii) losses if the opposite, the curve (bear flattened), and expires worthless if (iii) bull flattening; or (iv) bull steepening occurs (see Figure 6.8). Unlike spread strategies with only Eurodollar futures, this has two more distinctive outcomes of becoming worthless (see Figure 6.8).

Also, although the short legs of this strategy have unlimited loss potential, the strategy has a “natural floor” assuming the fact that the spread between Eurodollar future contracts that have close maturities will not radically change. Nevertheless, the strategy may incur losses.

Risks are an important consideration here. The manager must be mindful of being able to properly quantify the risks of individual strategies as well as at the portfolio level, as some positions may be correlated and exacerbate overall risk. Indeed, strategies with negative correlation may reduce the risk of the overall portfolio. It should be noted that the risks of the two strategies will not always add up to their arithmetic sum.

In addition, it should always be borne in mind that options are non-linear products. The losses may grow exponentially if the market moves against you, and may therefore be potentially too risky. Some strategies could also entail theoretically unlimited losses. Therefore, limited loss strategies, or practically limited loss strategies, are best suited for conservative investors such as central banks. As well as a good theoretical understanding of options and related risks, the availability of tools for measuring, analysing and monitoring those risks are therefore essential prerequisites. Risk analysis starts with pre-trade, and portfolio managers require suitable tools for analysing and visualising both the potential benefits and the risks of various strategies.

Good coordination between portfolio managers and risk managers, is also helpful in understanding the overall risks the organisation is taking, as well as checking that the views of individual traders are in line with the broader understanding of either market conditions or the objectives set by the reserve’s management function.

While having limited risk appetite as a central bank, it is still possible to allocate some portion of the total risk budget to active option strategies. Setting appropriate limits on the total risk of the options portfolio and having proper skills in place enables portfolio managers to bring active returns and improves diversification.

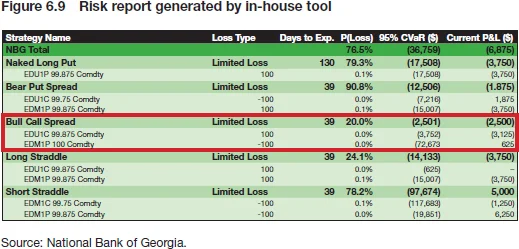

It is the non-linearity of options that could lead to large and unexpected losses that require strong risk management capacity in place. To be able to measure risks for unlimited loss strategies and strategies on different underlying assets, we have created a tool in Matlab that simulates payouts and measures tail risk (CVaR) for each strategy and portfolio overall (see Figure 6.9 below).

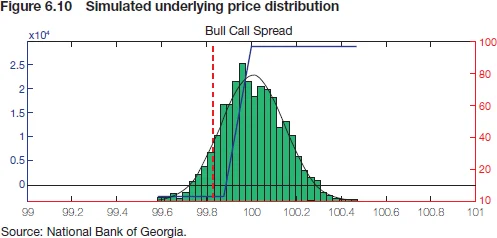

From the example in Figure 6.9, one can see that the short unlimited loss strategy has the highest contribution to total portfolio risk, and its CVaR exceeds total portfolio CVaR. As shown in Figure 6.10, one of the legs of the short strangle strategy has greater risk than the strategy or total portfolio itself. The tool generates charts with simulated underlying price distribution, option strategy payout (blue line) and current underlying price (dotted red line).

Conclusion

Options, if used with the proper knowledge, can be suitable for central banks’ reserves portfolios. They help enhance return on both the particular option strategy as well as on the overall reserves portfolio, and help to improve portfolio managers’ skills and make the investment process more stimulating. This improvement does not come at the expense of lower liquidity or safety. However, as a word of caution for those who will give it a try, there is no free lunch, and market risks should be measured and monitored carefully. If managed with proper skills and tools, they are certainly worth considering, as interest rate options could blend well with reserve managers’ traditional realm of fixed income investments

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: http://subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com