Economics

Blanchard calls for rethink on costs of debt

Fiscal cost of public debt may be zero, macroeconomist argues, but that does not make debt costless

US payrolls data proves strong

Non-farm payrolls beat expectations and wage growth rises, despite fears of a global slowdown

EME banks have ‘substantially’ increased global footprint – BIS research

Study finds emerging market banks have taken a greater role as their home economies have grown

Lower oil prices and stronger lira send Turkey and Argentina diverging

In 2019, analysts expect inflation to drop sharply in Argentina and to bounce back in Turkey

Bank of England to overhaul consumer interest rate statistics

Changes are designed to ensure the statistics reflect consumers’ experiences “as closely as possible”

Podcast: The post-crisis world

Andrew Metrick says central banks have changed dramatically since 2008, but more work may be needed to develop new models

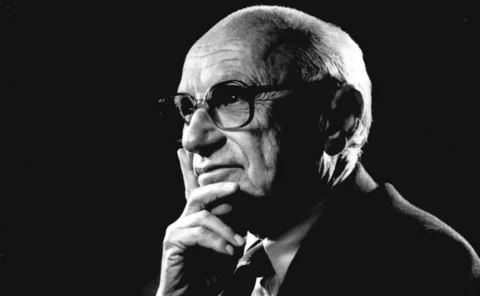

Oxford academic argues Milton Friedman is misunderstood

James Forder says Friedman had a bigger impact on neoclassical economics than on monetarism

BoE paper proposes fix for flawed rate expectation estimates

Model augmented with overnight indexed swap rates performs better, author says

BoE paper proposes nowcast method for GDP revisions

Dynamic factor model reveals information on how early estimates may be revised, authors say

IMF’s Adrian calls for forecasting upgrade

Policy forecasts should do a better job of capturing endogenous risk, economist says

Agent-based models: a new frontier for macroeconomics?

Agent-based modelling is opening up new possibilities for economics, but the discipline is still struggling to move from the sidelines to the mainstream

BoE paper highlights flaws in bank modelling

Many models still treat banks as “warehouses”, authors say, with important modelling implications

Africa at risk from faster policy normalisation – Kenya’s Nyaoga

Higher interest rates could threaten portfolio inflows for a region struggling with price rises

Former Fed chair laments US disarray

“How can you run a democracy when nobody believes in the leadership of the country?”, Paul Volcker asks

Tunisia’s El Abassi on central banking during a regional security crisis

Central Bank of Tunisia’s governor talks about capacity building, evolving relations with the IMF, integration among the Arab states and using technology to foster inclusion

Haldane examines ‘puzzling pattern’ of weak wage growth

Average weekly wages are now lower than before the crisis, in real terms

Haldane to lead effort to boost UK productivity

BoE chief economist appointed chair of the Industrial Strategy Council

Solid US economy contributes to higher 10-year Treasury yields

Inverted yield curve less likely as long-term growth and inflation expectations rise

Nafta deal to reduce uncertainty in Canada and Mexico

Regional rate-setters have become increasingly concerned about effects of trade disruptions

Italy’s expansionary budget increases pressure on debt

Draghi warns government plans have tightened financial conditions for households and businesses

US growth remains solid in Q3 – Atlanta Fed

Real-time GDP estimation signals 4.4% growth in current quarter

Market power, intangibles and risk premia behind low risk-free rates – paper

Brookings paper questions savings glut and technological slowdown hypotheses

Book notes: The other half of macroeconomics, by Richard Koo

Richard Koo questions whether central bank policy can work during a balance sheet recession, writes Graham Bannock

Automation of financial services poses problem for labour market

Central bankers fear the labour market may not recover as quickly as during previous technological revolutions