Payments

CBDCs must be interoperable – Swift and Accenture paper

Swift plans new CBDC trials for members across traditional payment rails

Fintech & IT Benchmarks 2021 – presentation

Central Banking’s fintech and IT subject matter specialist Rachael King speaks with Christopher Jeffery about fintech and IT staffing and salaries, research and investment, system resilience, CBDCs and the wider fintech ecosystem

Sanctions must go for nuclear talks to succeed, says Iran governor

Hemmati has played major role in sanctions-related diplomacy

Digitalisation will not render Norwegian banks obsolete – deputy governor

Use of cash falling rapidly, as Norges Bank studies options to issue a CBDC

RBNZ gains new FMI oversight powers

Central bank and FMA will be able to set standards for systemically important infrastructures

Fed looks to boost competition in debit card payments

New rule will support legal right to at least two payments options for merchants

Bank of Canada to become default payments regulator

Central bank will oversee any company not already regulated under proposed law

Fed clarifies account access rules for fintech firms

Proposals address growing number of firms seeking access to the central bank’s balance sheet

UAE’s central bank connects RTGS system to Swift tool

New initiative allows participants to monitor progress of transactions in real time

Singapore’s SWF starts work on cross-border payment network

JP Morgan, DBS Bank and Temasek say project will build on collaboration with MAS

MAS and Bank of Thailand connect retail real-time payments

Transaction times will be reduced to minutes as opposed to one to two days, central banks say

MAS proposes ‘unbundling digital currency stack’

Layers of governance could allow single common settlement platform for CBDCs

The evolving ‘strategy function’ in central banks

Some institutions participating in a survey of 27 central banks still struggle to fully harness an effective ‘strategy function’, according to the ECB’s Jean-Charles Sevet and Alejandro de la Cuesta

DNB survey finds 49% of respondents ready to use digital euro

Over half of sample had not heard of central bank-issued digital currency, survey finds

Zhang Tao on the IMF’s fintech agenda, CBDCs and big tech oversight

IMF deputy managing director speaks about the fund’s perspectives on CBDC operating frameworks, regulating big tech and macrofinancial oversight in a digital world

BoE broadens access to RTGS with ‘omnibus’ account model

Accounts will allow payment system operators to ‘pool’ client funds for transfers in central bank money

BoE and Treasury launch CBDC task force

Central bank also forms new division to lead “internal exploration” of digital currency

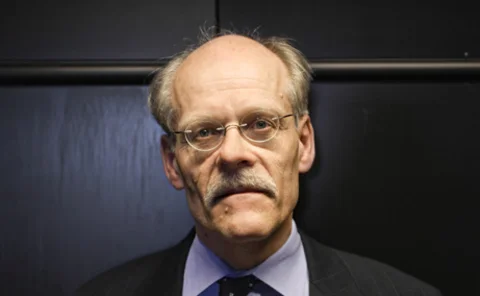

Sweden may have a digital currency in five years, says Riksbank governor

Sveriges Riksbank is testing e-krona pilot as Swedish cash use falls rapidly

Fintech & IT Benchmarks 2021 report – executive summary

Shedding light on fintech initiatives, staffing, salaries, cyber security and more

RBI to give some non-banks access to payments systems

Indian central bank to allow non-bank payment service providers to use payments architecture

Fintech & IT Benchmarks 2021 report – detailing the evolution of technology

Benchmarking data sheds light on staffing trends, priority areas of research and uptake of new technology, cyber security challenges and central bank digital currencies

ECB’s digital euro consultation says public worried over privacy

Nearly half of responses to ECB come from Germany

Regulating big tech and non-bank financial services in the digital era

Big tech incursions into financial services in China and elsewhere demonstrate the potential benefits of adopting a digital-bank or holding-company approach to financial regulation

Central banks take less than 50 minutes to fix critical outages

Time tolerances for critical system downtime range from one to 32 hours