Monetary aggregates

Fed officials reveal further details of balance sheet plans

Fed discusses letting assets fall off its balance sheet at the same pace as economic expansion

Central Bank of Iran may be forced to print money to pay government

Governor warns lawmakers that forcing CBI to pay monthly dividend is unwise

BIS’s Borio calls on economists to take money more seriously

Money is too often explored in isolation, or ignored completely, the BIS economist says

Angola improves data transparency with new hub

Statistics deemed “critical” by the International Monetary Fund will be published in one place

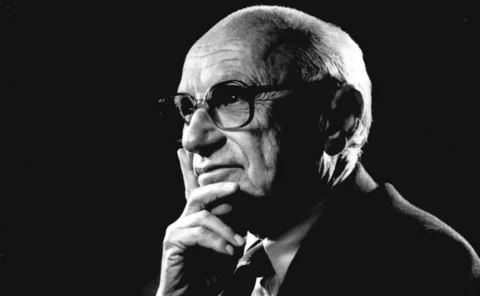

Oxford academic argues Milton Friedman is misunderstood

James Forder says Friedman had a bigger impact on neoclassical economics than on monetarism

Money matters for macro fluctuations – Fed paper

Working paper says previous research by Schularick and Taylor may have been flawed

RBA minutes drop hawkish language

Minutes of June meeting appear to contrast with recent remarks by governor Philip Lowe

Swiss reject radical monetary proposals

Less than a quarter of people vote for new monetary system; activist says vote has started a conversation

Switzerland weighs bold monetary experiment

On June 10, Switzerland will vote on whether to revolutionise its monetary system and hand the central bank a monopoly on money creation

Norges Bank does not rule out launching digital currency

Central bank publishes first phase of research, saying a digital currency could be an alternative to deposit money when cash usage declines

Denomination matters for banknote demand – paper

Bank of Canada paper finds people make different choices when holding high-value banknotes

Canadian deputy: inflation target renewal aids policymaking

A renewal period offers the bank a research opportunity to examine monetary policy framework; such research prompted a decision to maintain inflation target at 2%

Uzbekistan poised to float currency

From September 5, restrictions on foreign exchange trading will be lifted, paving the way for a new operational framework at the central bank

RBI launches economics blog

“Mint Street Memos” comprise brief reports and analysis from RBI economists; first post studies beneficial effects of demonetisation for “financialisation” of savings

“What would Allan say?”

Central Banking Publications founder Robert Pringle finds pearls of wisdom in his email correspondence with the late Allan Meltzer

Central Bank of Egypt hikes rate in bid to rein in rapid inflation

Inflation is starting to slow after impact of devaluation but is still running at close to 30%, the central bank says

Regulatory tightening has caused decline of money growth, PBoC official says

PBoC official says regulatory policy and monetary policy go hand in hand; recent flurry of regulatory activity is impacting monetary policy

Making the rules and breaking the mould (Allan Meltzer: 1928–2017)

John Taylor writes about the extraordinary life of a pioneering economist whose lifelong work defied traditional rules – but one who strongly advocated them for central banks

Central Bank of Egypt battles to contain devaluation impact

Inflation has rocketed since Egypt aligned official and black market exchange rates, forcing the central bank to take action

Monetary aggregates useful as eurozone inflation predictor – paper

“Predictive content” of monetary aggregates has improved since 2012, ECB paper says

BoE paper tackles ‘sectoral co-movement puzzle’

Adding labour market frictions and habit formation helps to solve the problem of models implying a monetary contraction produces little response in output

Policy-makers should base analysis on broad set of monetary aggregates, paper argues

Analysis of the stability of demand for components of monetary aggregates in the eurozone argues against reliance on a single measure, researcher says

State money and bank money: lifting the fog around QE

Steve Hanke says economists are missing important details by focusing on interest rates, rather than the money supply

BIS paper: money growth-inflation link weakens, credit link grows

Authors find money growth is less important in driving price changes, but credit growth is becoming a more critical factor in financial crises