Euro

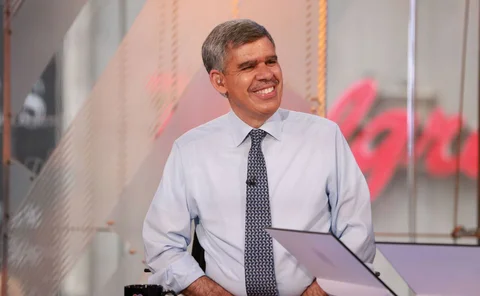

El-Erian on Covid-19 policy risks, ‘zombie’ markets and central bank capture

Former Pimco chief says Fed move into high yield is a step too far, new rules needed on leverage and false liquidity, and narrow window emerges for central banks to shed some of their policy load

Beware of capital: much ado about nothing?

Capital increases can be offset by asset valuation, provision and income recognition forbearance

Debelle: regulation could be ‘helpful’ to FX code

As EU weighs regulation of spot market, GFXC chair dismisses key industry argument

Fed opens dollar funding to majority of central banks

New repo facility aims to ease strains caused by global flight to the safety of dollars

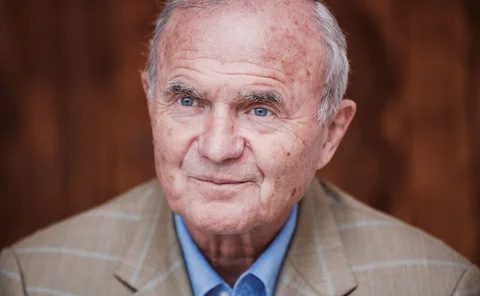

Major economies already engaging in ‘currency wars’ – former IMF chief

De Larosière floats new commodity-based exchange rate regime; says “trust” is key to avoiding “beggar-thy-neighbour” policies

The dawn of a safer and sounder European banking sector

Implementation of two pillars of banking union has led to significant improvements in the safety and soundness of the European banking system

Dollar crunch eases as central banks step up swaps action

Core swap recipients will offer daily dollar auctions; cross-currency basis narrows

Fed expands network of swaps to emerging markets

Emerging markets will now have direct access to a dollar backstop, but it is still limited

The Tokyo Olympics: downside risks prevail

The Bank of Japan’s latest stimulus effort seems to be weak, and comes at a time when the benefits of hosting the Tokyo Olympics may be overstated – even if the games still take place

Central banks and banks: a changed relationship

The development of large, complex international capital markets has reshaped the relationship between central banks and their commercial counterparts

Do low rates spur investment?

Many believe low interest rates spur investment, but there appears to be little hard evidence to support such claims, writes former IMF head Jacques de Larosière

Why Bulgaria needs to deepen its currency board

The BNB’s currency board rules should be extended to transaction deposits at commercial banks, which could in turn issue digital currencies, even in the event of euro adoption

Stability versus solvency

There is still far too much regulatory forbearance on troubled bank debt. More on-site inspections and genuine writedowns are needed to fix the banking system

Book notes: The power of money, by Robert Pringle

Economists would benefit from reading this “remarkable” book, which contains “brilliantly written snapshots” about money’s historical and social roles

Interview: Luiz Awazu Pereira da Silva

BIS deputy general manager talks about the obstacles central banks face with regard to climate change and why the status quo needs to evolve

Advanced economies’ inflation more synchronised – Bank of Spain paper

Headline inflation rates are more highly correlated than core inflation, authors find

Schnabel takes on Germany’s ‘false narratives’ on ECB policy

Criticism based on “half-truths” imperils trust in single monetary policy and “undermines European cohesion”

Bulgaria: long live the currency board

Bulgaria should reject the euro and extend its currency board to cover bank deposits

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

Custody initiative: Euroclear

The securities depository has debuted instant dollar settlement in central bank money outside the US – a service that has virtually eliminated settlement risk

Governor of the year: Mark Carney

Carney has played a vital role in managing Brexit risks while driving efforts towards climate, payments and dollar funding reform

Watch out for Brexit cliff edge 2.0, experts warn

Measures to mitigate a sharp rupture for financial services could be less likely at end-2020

Debt securities still key in capital flows to EMEs – BIS

Latest global liquidity statistics show ongoing growth in euro and dollar liquidity

Forex market growing, but more risky – BIS review

Reduced reliance on PvP and heightened fragmentation threaten market resilience