Asset prices

Book notes: Asset management at central banks and monetary authorities, edited by Jacob Bjorheim

This excellent book fills a critical gap existing since IMF guidelines on asset management were revised

Fed’s 2021 stress test includes major asset price shock

CCAR will evaluate 19 largest banks; scenario includes 55% fall in equity prices

The Covid crisis, central banks and the future

Crisis responses have had positive initial outcomes, but also exacerbated significant underlying challenges that raise concerns related to exit strategies and the future for central banks

ECB steps up work on climate change

Central bank launches climate change centre and invests in new BIS green bond fund

Is there a path between the Covid abyss and chasm of financial risk?

Macro-prudential policies are being used to prevent economies from falling into the Covid abyss while also ensuring that a correction in ever-higher asset prices do not crush the economy. Are both objectives achievable?

BoE expands asset purchases as UK locks down again

MPC publishes more pessimistic forecast of 11% growth contraction and high unemployment

Banking sector resilience ‘likely to be tested’ – IMF’s Adrian

Fund’s stability report says vulnerabilities are high and rising, creating difficult policy choices

Japan’s economy needs bolder policies

PM Abe announces decision to step down with many goals still unachieved

RBNZ investigating use of negative rates, official says

New Zealand central bank would only use measure if necessary, assistant governor says

James Bullard on the Fed’s policy review, FSOC and forecasting jobs data

St Louis Fed president discusses his support for average inflation targeting, his concerns about US Treasuries market function, non-bank regulatory weakness and negative rates, as well as the unexpected success in using Homebase data to predict highly…

After social distancing: prepare for national distancing

If the Covid-19 pandemic triggers a desire to onshore production, international capital flows will come under a new spotlight

Fed’s safety nets are ‘fundamentally unsustainable’

The Fed’s new safety nets will allow “zombie companies” to thrive and drag down productivity; ever-increasing levels of interventions are “fundamentally unsustainable, intertemporally”, says William White

Fed poised to purchase corporate bonds next week

New York Fed will create a portfolio to track the US corporate bond market under new plans

Football stadiums to airlines: BoE reveals commercial paper holdings

Central bank has taken on exposures to a wide range of businesses – including polluters

Covid-19 forcing reserve managers to rethink asset allocations

Adjusting asset allocations and dealing with reduced market liquidity are key challenges for reserve managers, survey reveals

Central banking enters a new era

Central banks face a delicate balancing act to preserve their reputations as they evolve into ‘buyers of last resort’ and some of their actions appear functionally equivalent to ‘monetary financing’

What would yield curve control mean for Fed’s asset purchases?

Policy may imply shift in rationale from crisis to recovery, and potentially more volatility in purchases

Rising to the challenge – Reserve management in an uncertain world

Amid unprecedented measures being taken by central banks and governments to combat the global Covid‑19 pandemic, BlackRock‘s Stephan Meschenmoser, Laszlo Tisler and Crystal Wan compare and contrast BlackRock’s model portfolio against its high-grade…

Banks are ‘inherently unstable’, BIS paper finds

Researchers study the many roles banks play and find all of them tend towards instability

BIS paper: twin financial cycles can ‘turbocharge’ crashes

Policy-makers should differentiate between domestic and global cycles, authors say

Global carbon taxes are coming: central banks must prepare

The next financial crisis could be a green one. Are central banks doing enough to prepare?

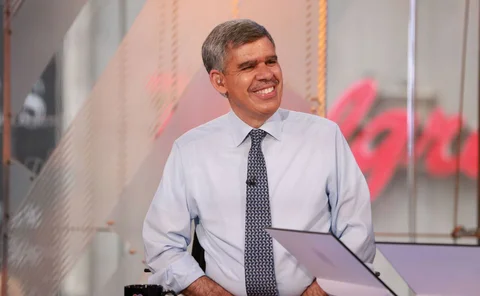

El-Erian on Covid-19 policy risks, ‘zombie’ markets and central bank capture

Former Pimco chief says Fed move into high yield is a step too far, new rules needed on leverage and false liquidity, and narrow window emerges for central banks to shed some of their policy load

World Bank says sub-Saharan Africa destined for first recession in 25 years

Growth could fall as low as -5.1% as largest economies struggle with Covid-19 repercussions

ECB paper presents new model for ‘fire sale’ contagion

Agent-based model shows asset managers spreading contagion during larger liquidity shocks