Research

Fed paper explores rate hike impact on money markets

Monetary tightening likely to impact flows in and out of Fed’s overnight repo facility

Old people hit hardest by inflation, research finds

Authors find income effects and “Fisher channel” have the biggest impact on Spanish households

IMF paper explores second-round effects of oil shocks

Authors find oil shocks have greater impact where inflation is already high

IMF paper offers ‘fear-based theory’ of economy

Central banks risk distorting the economy if they don’t move interest rates to offset “fear cycle”

Eurozone repo markets are slowing policy transmission, ECB paper says

Dealer banks use market power to get better prices from other institutions

Reverse bond auctions are useful crisis tool, ECB paper finds

DNB’s use of reverse auctions increases liquidity and stability of bill market, researchers say

Big tech firms may suffer from ‘too much information’ – BIS paper

Firms that pry too much into customers’ affairs may find themselves with no business, authors say

BoE paper analyses drivers of price setting

Panel data on UK firms reveals asymmetry in how firms decide to raise prices

Fintech needs better oversight as risks grow, FSI says

Basel-based group sees room for system-level testing and closer scrutiny of tech firms

Housing affordability dropping across the US

Fed’s large rate hikes and constrained housing supply create tough market for buyers

Fed paper explores information problems in financial panics

Tight liquidity can cause investors’ beliefs to become “systematically divorced from fundamentals”

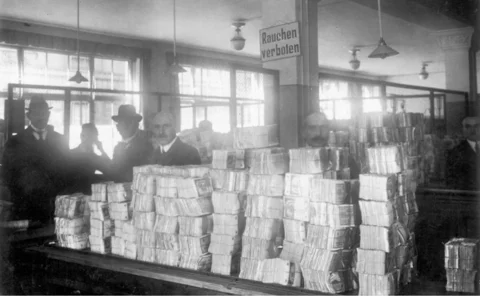

Long-term data can shed light on current inflation – NBER paper

Authors suggest first half of 20th century has clearer parallel to current inflation than 1970s

ECB rate hikes could damage climate change policies, paper finds

Researchers claim tighter financing conditions will hamper transition to capital-intensive green technologies

Firms use supply chains to predict inflation – IMF paper

Authors find expectation formation diverges from rational expectations hypothesis

Monetary policy ‘increasingly synchronised’, say IMF officials

Very few central banks have bucked the global trend since the start of the pandemic

Colombian study estimates policy impact on capital flows

Meta-analysis using web scraping finds central banks have more control over some flows than others

Central banks weighing up CBDC offline alternatives

Institutions are testing ways of allowing digital payments without the internet

Activity-based regulation will not guarantee level playing field – BIS paper

Authors propose framework to clarify use of entity- and activity-based regulations

BIS report highlights challenge of modelling green reserve portfolios

Survey of central banks finds legal mandates and liquidity make green reserves management difficult

ECB paper examines unanchored inflation expectations

Public reacts more strongly to larger and downward inflation surprises, researcher finds

IMF stresses inflation risks may rise further

In such a case, central banks will need to be more resolute in securing price stability

Eurozone debt likely unsustainable without QE – BIS paper

Authors find benefits of ECB’s PEPP extend beyond the end of the bond-buying programme

ECB paper examines equity markets’ treatment of climate risk

Researchers look at public perceptions, investors’ judgement and firms’ risk premia

Big tech links are ‘policy blind spot’, says FSI

Basel-based institute says tech firms are “increasingly intertwined” with financial sector