G20

Benoît Cœuré on CBDCs, stablecoins and central bank fintech co-operation

BIS Innovation Hub chief voices concerns about the timing of stablecoin and CBDC roll-outs, fintech risks for supervisors and monetary policy, and details development plans for eight innovation locations

IMF proposes $50bn plan to ‘end the Covid-19 pandemic’

“Upfront” financing is needed to accelerate vaccinations, say Georgieva, Gopinath and Agarwal

Zhang Tao on the IMF’s fintech agenda, CBDCs and big tech oversight

IMF deputy managing director speaks about the fund’s perspectives on CBDC operating frameworks, regulating big tech and macrofinancial oversight in a digital world

IMF weighs up $650 billion SDR issuance

Figure would allow Biden administration to avoid a vote in Congress

IMF grants Tonga $10 million emergency loan

Fund’s Article IV report expresses concern about banking sector; predicts GDP contraction

The role of Tips for the future payments landscape

Tips could support euro CBDC plus cross-border payments in many currencies

Hernández de Cos on ECB policy, crises responses and Basel reform

Spanish governor and Basel Committee chair Pablo Hernández de Cos favours a form of average inflation targeting, says ECB is willing to boost stimulus and Basel reforms not diminished by Covid-19 exceptions; stresses the need for structural reform and…

New Isda ‘fallbacks’ critical to making Libor transition a ‘non-event’

New protocol and supplement offer a transition away from Libor rates in 2021, despite CFTC saying 2,400 companies still exposed and Fed extending some US libor contracts until mid-2023

Olli Rehn on AIT, market neutrality and EU fiscal policies

The Bank of Finland governor talks about the ECB’s strategy review, market failure on climate change, lessons from the sovereign debt crisis, and the Draghi legacy effect on Covid-19 responses

G20 agrees ‘common framework’ on debt relief

Leaders welcome decision, but criticise private sector for failure to act

Zambia prepares for debt default

Talks on payment freeze fail as G20 prepares to debate further debt relief

Banks and regulators call for global climate risk standards

Carney and Winters warn private sector cannot move much further without lawmakers

G20 delays decision on poor countries’ debt relief

International efforts have been “unambitious, unco-ordinated and uneven” – prominent economists

FSB unveils ‘comprehensive plan’ to reform global payments

“Roadmap” for cross-border payments to be considered by G20 leaders this week

Estimating the cost of a pandemic grant for the world’s poorest economies

The cost of support measures for vulnerable economies is manageable, says Steve Kamin, but political leadership may be lacking

Covid-19: a watershed moment for China’s BRI?

China faces a delicate balancing act when it comes to forgiving and restructuring Belt and Road Initiative debt while preserving the soundness of its financial institutions

IMF and World Bank chiefs call for more action on debt relief

But G20 fails to agree extension to the Debt Service Suspension Initiative

BIS and G20 launch cloud-based ‘tech sprint’

New initiative will help regulators leverage technology to improve supervision of financial sector

G20 agrees debt relief for poorest nations

IMF and World Bank welcome “powerful, fast-acting initiative”

Interview: Luiz Awazu Pereira da Silva

BIS deputy general manager talks about the obstacles central banks face with regard to climate change and why the status quo needs to evolve

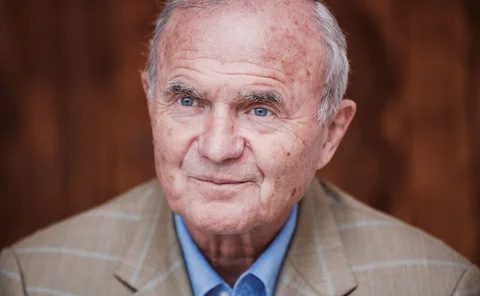

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

Mark Carney on joined-up policy-making, forward guidance and Brexit

BoE governor rules out negative rates and change to inflation targets, offers update on too-big-to-fail and use of CCyBs, highlights challenges of an asymmetric monetary system, hits out at cumbersome payments and warns Facebook’s libra cannot ‘learn as…

IMF’s Adrian on the big tech threat and why a ‘non-system’ works

The IMF’s financial counsellor speaks about risks from big tech’s move into fintech, the fund’s efforts to craft well-targeted policy guidance and why the current international monetary ‘non-system’ works

PBoC vows to keep currency stable

Central bank governor says renminbi is at an appropriate level after it breaks ‘7:1’ against the US dollar