Federal Reserve Bank of New York

CLS proposes second-tier FX settlement system

Stripped-back system for EM currencies mooted to tackle rising settlement risk

Chile and China expand bilateral swap line

Central banks more than double size of swap line and expand scope of use

Q&A: New York Fed’s Stiroh on climate change and Covid

Co-chair of Basel task force discusses possible supervisory approaches to climate risk

BIS expands innovation hub network

Several new locations unveiled in Europe and North America

NY Fed economists weigh in on yield curve control debate

Jury still out on Japan’s measures to control yield curve but there is “one clear benefit”, researchers say

New York Fed to tighten repo operations

Fed sees “substantial improvements” in dollar funding markets

Appetite for renewed Fed dollar swap lines in doubt

With up to $300bn of positions nearing expiry, some say FX swap market can meet banks’ funding needs

Fed could exploit helicopter money with digital currency system – former officials

Simon Potter and Julia Coronado propose recession insurance bonds, consumer QE and Fed-backed digital currency as crisis tools

US consumers expect more fiscal support – New York Fed survey

Consumers assigned a 40% chance of more federal welfare benefits in next 12 months

FOMC considers more aggressive forward guidance

Officials discussed state-contingent forward guidance and yield curve control, April minutes show

Covid-19 may accelerate US firms’ turn away from China – New York Fed

Import data shows firms have used non-Chinese suppliers to replace some lost trade

Fed will begin ETF purchases today

Central bank outlines fund selection strategy but keeps investors guessing on specifics

Fed set to adopt ‘elements’ of price-level targeting

Covid-19 could act as a catalyst for a Janet Yellen-supported Fed move to adopt elements of price-level targeting. But questions remain about the timing of such a move

New York Fed paper finds possible failings in US pandemic aid

Research on Paycheck Protection Program says some heavily virus-affected areas of US may be losing out

Tighter supervision improves bank performance – NY Fed paper

Researchers examine performance of heavily and lightly regulated banks from 1991 to 2014

Fed’s balance sheet increases by 50% since March

Total assets now just shy of $6.4 trillion, a new record high

Fed takes first step to unwind repo support

Repo market is showing signs of “more stable” conditions, New York Fed says

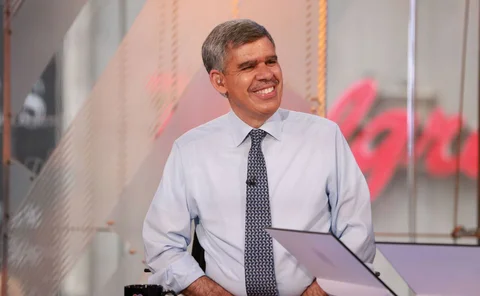

El-Erian on Covid-19 policy risks, ‘zombie’ markets and central bank capture

Former Pimco chief says Fed move into high yield is a step too far, new rules needed on leverage and false liquidity, and narrow window emerges for central banks to shed some of their policy load

People: Sarb and BoE renew senior appointments

Senior Sarb and BoE officials receive new terms; MAS picks new assistant managing director; ECB appoints director; William Dudley takes consulting job

Fed opens dollar funding to majority of central banks

New repo facility aims to ease strains caused by global flight to the safety of dollars

Fed’s balance sheet could see massive further growth

Response to coronavirus has already pushed Fed’s holdings up to record levels

New York Fed to offer $1 trillion per day in repo funding

Move sends message the Fed stands ready to meet any increase in funding demands over coming period

Central banks step up liquidity support

RBA, Bank of Canada, Norges Bank and Riksbank all increase their liquidity interventions

Fed to flood repo market with up to $5.5 trillion

NY Fed unveils substantial liquidity package as analysts warn massive market disruption is possible