Iris Yeung

Iris Yeung is a reporter for Central Banking, based in Hong Kong. She holds a masters in international political economy from the University of Warwick, and was previously a reporter for the Hong Kong Economic Times.

Follow Iris

Articles by Iris Yeung

IMF warns Chinese banks are undercapitalised

The IMF report highlights the insufficient capital of Chinese banks, conflicting tensions of growth and stability, and the financial system’s complexity

More easing next year if inflation does not pick up – RBNZ

Global supply chains, the rise of China and the digital economy led to a low traded-goods inflation

RBNZ eases housing market restrictions

New government’s policies should “dampen” housing market pressures, acting governor says

Central Bank of Myanmar retreats from stricter loan rules for banks

CBM loosens regulations on overdraft facilities in response to market concern

Singapore broadens push into e-payments

Singapore expands payments regulation frameworks and launches a common QR code for e-payments

China takes fresh steps to rein in financial sector risk

Five regulators jointly release standardised rules on asset management products

Doubts emerge over RBNZ mandate plans

Acting governor Spencer says a dual mandate would have little impact, but expresses concern over a committee structure; former RBNZ economists weigh in

Hong Kong and Singapore to collaborate on fintech

The first joint initiative of the two rival cities is to link the trade finance platforms with a DLT-backed interface

China’s party congress hints at new PBoC chief

Contest narrows to banking regulator head Guo Shuqing and Hubei province party secretary Jiang Chaoliang

Widening exchange rate band is not a top priority – PBoC’s Zhou

Zhou makes first public confirmation he is set to retire soon; warns the country’s excessive optimism could lead to a “Minsky moment”

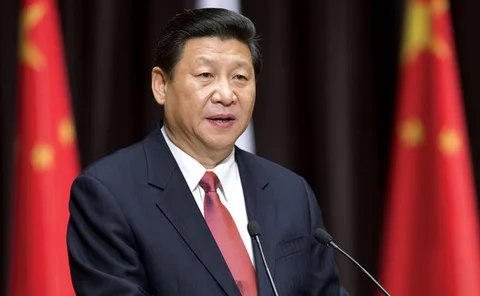

Xi sees renminbi taking greater role in global monetary system

President Xi Jinping calls for quality and equality of growth rather than speed; flags plans to promote renminbi as global reserve currency

PBoC targets stability ahead of party congress

China's central bank has taken several measures to boost stability in the run-up to the Communist party congress, which starts on October 18

Low volatility challenges central banks – BSP deputy governor

BSP deputy governor examines the correlation between volatility and uncertainty, and the calibration of monetary policy and macro-prudential policy in the Asean region

HKMA rolls out initiatives to promote ‘smart banking’

Hong Kong authority plans upgrade of supervisory sandbox and modified virtual banking guidelines; real-time retail payment system will be one of first to offer immediate settlement

Bank Indonesia under pressure from falling inflation

Bank Indonesia cuts rate for the second consecutive month; policymakers in Indonesia have been struggling to hit ambitious growth targets

HKMA pledges $1bn to IFC infrastructure platform

HKMA commits $1 billion of its Exchange Fund to International Finance Corporation’s syndicated loan platform to invest in infrastructure projects

MAS’s Chia points to the value of EM bonds

Singapore’s reserves and markets chief says interest in onshore Chinese bonds may act as a catalyst for emerging market bonds at a time when the outlook for yields from traditional reserve assets remains low

HKMA eyes infrastructure investments in Belt and Road initiative

Hong Kong’s central bank plans to invest reserves to help meet Asia's $1.7 trillion annual infrastructure needs, focusing on countries engaged in China’s Belt and Road initiative

PBoC dials back on forex controls

Renminbi ends 11-day rise after the central bank relaxes reserve requirements; analysts view move as attempt to end one-way trading

BSP launches reforms to spur domestic debt market growth

The country aims to develop its domestic capital market to finance its massive infrastructure program; reforms will be undertaken over a period of 18 months

Philippines sees strong ‘hot money’ inflow despite currency weakness

Net inflow of foreign portfolio investments into Philippines hits six-month high, in contrast to weakness in peso

China’s current credit trajectory is ‘dangerous’, IMF warns

Fund revises up China’s GDP growth forecast, but warns debt-fuelled growth is unsustainable

Malaysia starts to feel effects of Fed rate hikes

Fed rate hike in June reversed flows into Malaysian financial markets, leading to an increase in yields, a deprecation of the ringgit and a fall in the stock market; Thailand appears less affected

Bank of Japan cuts inflation forecast as policy remains on hold

The BoJ cuts its forecast for prices as it struggles to hit its inflation target; keeps policy steady