Iris Yeung

Iris Yeung is a reporter for Central Banking, based in Hong Kong. She holds a masters in international political economy from the University of Warwick, and was previously a reporter for the Hong Kong Economic Times.

Follow Iris

Articles by Iris Yeung

PBoC cuts reserve requirement in bid to support lending to smaller firms

Move may be "precautionary" response to slowing growth – analyst

HKMA buys HK dollar for first time in 13 years

HKMA chief says central bank is “fully capable” of defending local currency

Xi pledges to open up economy amid trade tension

China’s president adopts soothing tone, but some observers complain his remarks do little to change the situation

PBoC gains two-headed leadership

In appointing Guo Shuqing as party secretary at the PBoC, president Xi Jinping appears to be strengthening party control over the central bank

China picks Yi Gang to lead PBoC

US-trained Yi is viewed as a pro-market reformist, who has worked under his mentor Zhou Xiaochuan for two decades

China to merge regulators and expand central bank’s role

The PBoC will gain key powers from the regulatory commissions and report to the key committee

PBoC set for new governor

President Xi Jinping’s adviser Liu He widely expected to be named next PBoC governor

Macro-prudential measures should be made to last – RBNZ’s Spencer

Outgoing governor wants temporary framework for loan-to-value ratios to stay; says debt-to-income instrument should also be part of toolkit

Zhou says China is ready for bolder reform

Zhou Xiaochuan comments on further progress with liberalisation and financial market reforms in what is likely to be his last press conference as PBoC governor

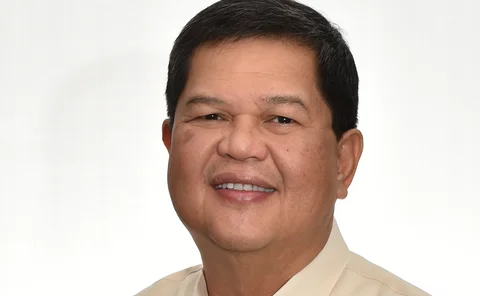

Philippines governor announces recovery from cancer

Espenilla reveals cancer treatment, and says recent policy reforms will not fuel rising inflation

Singapore seeks infrastructure investment boost

MAS and ministry of trade and industry to set up an infrastructure office to encourage local and international firms to build Asian infrastructure

China feels tighter financial conditions ahead of new year

Record-breaking bank loans contrast with slower broad credit growth, amid shift away from shadow banking

BoJ’s Kuroda in line for second term

Haruhiko Kuroda looks set to be the first governor to be reappointed in over 50 years, but the choice of deputies is unclear

Asian property developers face tougher scrutiny amid house price boom

Hong Kong and Singapore are putting more scrutiny on loans to property developers, as their housing markets continue to heat up

Bank of Japan increases bond purchases amid global sell-off

Both the prime minister and the governor see no rush to withdraw stimulus

Taiwan deputy nominated as next governor

Yang Chin-long seen as likely to follow the monetary policy stance of his predecessor, Perng Fai-nan

State Bank of Vietnam seeks to rein in credit growth

Target of 17% credit growth this year to contain risks

Bank Negara makes first rate hike since 2014

Bank Negara Malaysia is the first South-east Asian central bank to hike rates this year

Bank Indonesia launches joint initiative as rice prices bite

Indonesian central bank and government announce joint measures to control inflation arising from food price volatility

PBoC releases liquidity ahead of new year celebrations

RRR cut is expected to release liquidity to counter the seasonal tightening around Chinese new year

BoJ’s cut to bond purchases not an exit strategy, say analysts

Move was unexpected, but analysts do not see it as a sign the BoJ may be preparing to exit its stimulus programmme

PBoC tightens bond trading rules, relaxes renminbi controls

China’s financial regulators continue their efforts to deleverage the economy and promote renminbi internationalisation

Balancing reserves’ effectiveness and transparency

Why do countries accumulate more and more reserves if they know intervention may prove ineffective? Iris Yeung speaks to Canada’s Eric Wolfe

Cambodia shortens duration of liquid reserves ahead of election – reserves chief

De-dollarisation and lack of interbank market make forex intervention the only real policy tool left for National Bank of Cambodia