Sovereign debt

Designing a new global financial architecture

Developing a financial architecture for the future requires substantial thought about international capital flows and the role of institutional investors. By Bernd Braasch

HKMA strikes a cautious note on territory’s banking sector

Hong Kong Monetary Authority concerned about continued credit expansion in the territory and contagion risk from the European sovereign debt crisis

Renminbi could be adopted into SDR by 2015, says CentralBanking.com panellist

Latest Central Banking On Air debate asks if reserve mangers should invest more in emerging markets; panellists believe renminbi will be adopted as part of SDR with just the timescale in question

IMF warns of 'full-blown panic' eurozone break-up would cause

Latest IMF World Economic Outlook discusses possibility of a break-up of the eurozone; says disorderly exit of one member country would have untold knock-on effects

Reserve managers cling to the dollar but shun the euro, CBP survey finds

Central banks have reduced their euro reserve holdings and looked to diversify into non-traditional currencies due to ongoing eurozone tumult finds annual Central Banking Publications survey

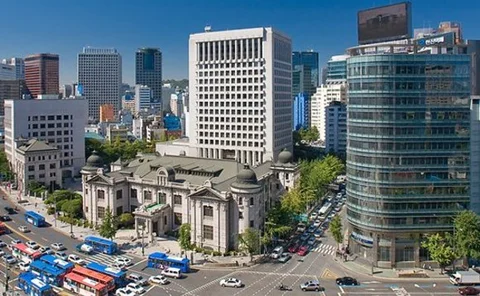

Korean government issuers unlikely to benefit if sovereign is upgraded – Moody's

Government-related issuers not likely to be upgraded alongside Korean sovereign as rating agencies place more weight on underlying credit fundamentals

Diverging views on US debt stimulate debate at NALM 2012

A difference of views emerged about the relative risks of US sovereign debt compared with alternatives during a panel discussion at NALM 2012 symposium on risk approaches in a post-crisis world

Interbank market ‘almost dead’ in Europe, says Banque de France’s Mongars

ECB operations are critical for European bank funding as the interbank market is all but broken, says NALM panellist

Nigeria needs more reserves and better inflation controls, says Fitch

Nigeria will need to further increase the size of its foreign exchange reserves and keep inflation in closer check if it wants to secure investment-grade status by 2020, says Fitch

OECD’s Gurría wants ‘mother of all’ firewalls in Europe

OECD secretary-general demands expansion of emergency funds available to struggling eurozone sovereigns; wants monetary conditions to remain ‘supportive’

Richmond Fed paper highlights benefit of debt ceiling

Fed research finds governments can see improvements in fiscal positions when utilising debt ceiling targets

Draghi applauds team effort on euro turnaround

ECB president says every institution in the eurozone contributed to turnaround witnessed since November; warns there is more to be done

ECB allows eurozone central banks to veto collateral

ECB says central banks in member countries can refuse bank bonds guaranteed by governments of countries involved in EU/IMF bailout programmes as collateral

ESRB assesses systemic risks to EU financial system

European Systemic Risk Board analyses key systemic risks to financial system in the EU; uncertainties surrounding sovereign debt and pressures on bank funding among top issues

Bank of Greece delivers policy report for ‘critical year’

Greek central bank announces bleak prediction for economy in 2012; calls on government to go above and beyond to ensure reform programme is implemented

Liikanen urges controlled and timely policy readjustments

Governor of the Bank of Finland applauds impact of emergency ECB policy steps and talks of careful unwinding of positions

IMF readies €28bn in support of Greece

International Monetary Fund managing director Christine Lagarde plans to get funds approved this week; Isda rules debt restructuring a ‘credit event’

Greece’s private bondholders approve ‘voluntary’ debt swap

An 85.8% majority approves Greek sovereign debt swap but strong-arm tactics raise concerns about the future legal certainty of sovereign bonds

South Africa must tackle capital flows ‘challenge’, says deputy governor

Sarb deputy governor says problems with capital flows in South Africa require “fresh thinking”; rand exchange rate fluctuations causing problems

EFSF gets go-ahead for collateral enhancement facility

Plan to restore worth to Greek bonds as collateral is authorised; two days after the European Central Bank was forced to stop accepting Greek bonds following downgrade

ECB rejects Greek bonds in reaction to rating cut

European Central Bank temporarily stops accepting Greek debt as collateral; move comes one day after rating agency drops country to a selective default rating

Buba’s Weidmann defends German role in eurozone rescues

President of the Deutsche Bundesbank says criticising German authorities for their action, or lack of it, in helping struggling eurozone counterparts is “quite inappropriate”

A new toolkit for eurozone survival

The eurozone’s short-term outlook depends on markets, voters, bureaucrats and politicians. Its longer term future requires radical change. Andrew Smithers considers the conditions that are needed for the eurozone to survive

EU leaders present plan for growth

EU member state leaders issue joint statement on restoring growth to the economy; all eyes on finance ministers’ meeting in Brussels