Sovereign debt

Fed expands lending facility to support municipal bond market

Political pressure mounting to support local governments; senator proposes bill to broaden QE powers

Riksbank resumes QE by buying government debt

Swedish central bank buys $245 million in sovereign debt and will buy covered bonds on March 25

Croatian central bank starts bond-buying programme

HNB also holds repo auction and may relax banks’ capital buffers in response to coronavirus

Lagarde misstep overshadows ‘bold’ measures, analysts say

ECB president seemed to have hampered governments’ debt financing at a critical juncture

Costa Rican central bank pulled into fiscal debate

Government split on how fiscal rule should be calculated as fiscal deficit continues upward trend

IMF staff say Argentina’s debt is unsustainable

Report calls for haircut for private creditors as Argentine government demands IMF debt forgiveness

Yield curve models overstate chances of US recession – ECB research

Models need to account for effects of QE asset purchases on bond premia, authors say

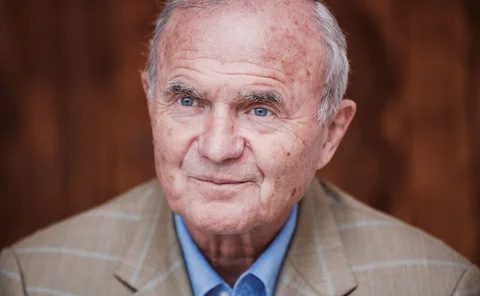

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

Eurozone banks increase illiquid assets after solvency shocks – DNB paper

Shift in asset holdings could create asset price distortions after banking crises, researchers say

Sovereign debt needs strong collective action clauses – ECB paper

CACs with bond-by-bond voting fail to prevent creditor holdouts, researchers find

IMF sounds warning over global debt

Debt in both public and private sector may leave many countries at risk in next downturn, IMF says

Eurozone bond purchases work as stabilisation tool – BoI paper

Researchers simulate effectiveness of sovereign bond purchases against both real and financial shocks

Chile’s forex intervention likely to stabilise peso – experts

Much depends on the reform programme the government chooses to adopt, however

Mexican governor defends autonomy as president questions it

Alejandro Díaz de León commemorates Bank of Mexico’s 25 years of independence

Emerging markets face growing debt risk – IMF paper

One-third of emerging market debt over-valued as low-income countries set to issue more

Argentina’s currency controls help stabilise peso and reserves

Uncertainty about the fiscal policies of the incoming president is contributing to falling bond prices

The challenges facing Christine Lagarde

The new ECB president will need to focus on a successful review of the ECB’s monetary and communications policy, while encouraging fiscal stimulus and structural reform

Riksbank sells Canadian and Australian bonds on climate risks

Swedish central bank based decision on high greenhouse gas emissions in Alberta, Queensland and Western Australia

New IMF chief maintains focus on unsustainable debt levels

Debt levels at all-time high and well over twice global GDP, Kristalina Georgieva warns

German finance minister offers deal on eurozone deposit insurance scheme

New proposals may not be enough to overcome other EU countries’ opposition

Germany’s tight fiscal policy may hamper ECB normalisation – IMF research

Sustained budget surpluses have reduced debt issuance and contributed to ever-lower yields

Was Draghi one of the great central bankers?

A look back at how Mario Draghi confronted the financial crisis and existential concerns about the euro

Philly Fed paper studies impact of Argentina's default on firms

Firms would benefit from mechanisms to ease switching lenders, researchers find

Norway’s SWF chief to step down after 12 years

Yngve Slyngstad presided over international diversification and the adoption of real estate, while total assets multiplied by four