Negative rates

ECB’s negative rates boosted lending – Bank of Italy paper

Banks increased credit to ex ante riskier firms, but did not see rise in failed loan rates, researchers find

Riksbank backs fiscal stimulus with massive QE programme

Swedish central bank increases loans to banks, cuts overnight lending rate to 0.2%

RBNZ reduces rates by 75bp in emergency meeting

Central bank says future purchases of government bonds preferable to lower rates

Central banks and banks: a changed relationship

The development of large, complex international capital markets has reshaped the relationship between central banks and their commercial counterparts

ECB likely to shy away from rate cut, analysts say

Central bank expected to unveil targeted measures to support banks and SMEs

RBNZ prepares unconventional policy tools

Central bank is not planning to use them yet, governor stresses

What can the ECB do now?

Central bank is facing coronavirus shock with limited room for further policy measures

Riksbank’s Breman says coronavirus does not demand looser policy yet

Swedish central bank abandoned negative rates in December; inflation declined sharply in January

Knot warns of drawbacks of negative rates

Consumers are increasing their savings rather than their consumption

Did the Riksbank abandon negative rates too soon?

In January, a key inflation measure dropped sharply. Policy-makers face difficult choices if inflation does not recover

Do low rates spur investment?

Many believe low interest rates spur investment, but there appears to be little hard evidence to support such claims, writes former IMF head Jacques de Larosière

Economist joins Bank of Japan’s rate-setters

BoJ board member in favour of continued QE but has expressed doubts on negative rates

Schnabel takes on Germany’s ‘false narratives’ on ECB policy

Criticism based on “half-truths” imperils trust in single monetary policy and “undermines European cohesion”

Dutch households sharply increased savings in 2019

Higher net incomes and the need to offset lower interest rates behind surge, says DNB

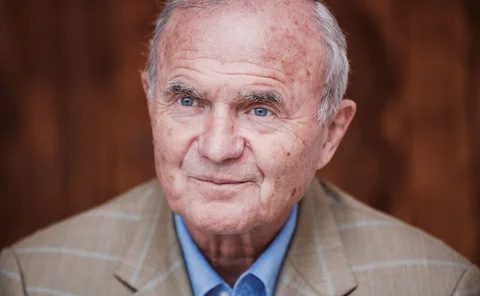

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

ECB’s Mersch warns of negative side-effects of ultra-loose policies

Policies may be contributing to risk-taking, high asset-price inflation and inequality, board member says

Trump’s criticism undermining confidence in Fed – Yellen

Political pressures could hurt central bank independence, says former Fed chair

Riksbank minutes show disagreements over December rate hike

Dissenting board members cite looser international policy, weak growth and below-target inflation

Lagarde awards Schnabel key policy role in renewed ECB board

Panetta leads market infrastructure and payments, banknotes and international relations

Rates have been falling for eight centuries – BoE research

Study casts doubt on major theories, including secular stagnation; author warns rates could “soon enter permanently negative territory”

Negative rates demonstrate shortcomings of currency

Many central banks have rates in negative territory. The distortionary effects of these policies raise broader questions on the design of money itself, writes Barry Topf

Schnabel and Panetta appointed ECB executive board members

The final distribution of responsibilities in January will determine the new members’ portfolios

Riksbank abandons negative rates

Swedish central bank increases repo rate by 25 basis points, but two board members dissent

De Guindos: Boost eurozone banks’ countercyclical capital buffers

Increases in counter-cyclical buffers should accompany decreases in other capital ratios, says ECB vice-president