Independence

The complex art of reserve management

The coronavirus lockdown represents another inflection point for central banks seeking to optimise the management of their $12 trillion in FX reserves

Economists debate monetary financing of China’s government debt

PBoC adviser dismisses idea of monetising government bonds despite calls from Ministry of Finance think-tank

The ECB, the lockdown and the monetary financing lock

The eurozone’s central bank may need to break its prohibition on monetary financing to fight the pandemic

Pandemic debt will test policy-makers – Richmond Fed research

Authorities may opt for “financial repression” policies with central banks keeping rates low – paper

German court leaves Bundesbank caught between two legal decisions

Ruling may hamper ECB’s new PEPP programme as it is not constrained by PSPP limits

Norges Bank proceeds to draw up contract of new SWF chief

Nicolai Tangen’s appointment came under scrutiny after it was revealed he asked incumbent for help during hiring process

Could engineering higher inflation help manage fiscal deficits?

Fiscal and monetary co-ordination could be a workable option for the Covid-19 recovery, Chicago Fed paper finds

Debts, deficits, central banks and inflation

Forrest Capie and Geoffrey Wood ask what insights history can provide for central banks and governments managing abrupt, large increases in debt

Norges Bank supervisory council requests information on SWF’s new head

Executive asked to answer questions on hiring process amid ongoing expenses scandal

Norway’s SWF leadership caught up in expenses scandal

Incoming chief executive asked current CEO for a favour weeks after inviting him to a seminar in the US

Proposed changes to law could damage independence – Swedish central bank

Lawmakers’ proposal would hinder crisis management capability, Sveriges Riksbank says

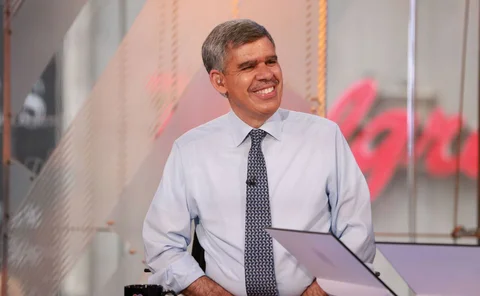

El-Erian on Covid-19 policy risks, ‘zombie’ markets and central bank capture

Former Pimco chief says Fed move into high yield is a step too far, new rules needed on leverage and false liquidity, and narrow window emerges for central banks to shed some of their policy load

Bank of England to lend directly to government

Central bank agrees temporary expansion of “Ways and Means” facility

The dawn of a safer and sounder European banking sector

Implementation of two pillars of banking union has led to significant improvements in the safety and soundness of the European banking system

Central banks grapple with dollar funding crunch

Indicators of stress hit highest levels since global crisis; dollar backstops may soon be tested

Coronavirus could require expanded QE powers – Rosengren

Congress should grant Fed ability to buy wider set of assets under severe scenario, Rosengren says

Ghana’s Addison on banking reform, innovation and the future of the eco

The Bank of Ghana governor speaks about the next steps in banking reform and why West Africa may need more time to start using a common currency

Costa Rican central bank pulled into fiscal debate

Government split on how fiscal rule should be calculated as fiscal deficit continues upward trend

ECB unveils plan for its strategy review

Eurosystem will host “listening” events with general public, academia and civil society organisations

Shelton gets little respite in Fed nomination hearing

Lawmakers unimpressed by her previous remarks and poor attendance record at EBRD meetings

RBNZ updates external whistleblower policy

Central bank will not deal with personal workplace issues and is encouraging the use of internal processes where possible

Cuban president appoints new central bank governor

Marta Sabina Wilson González was senior official at state-owned lender

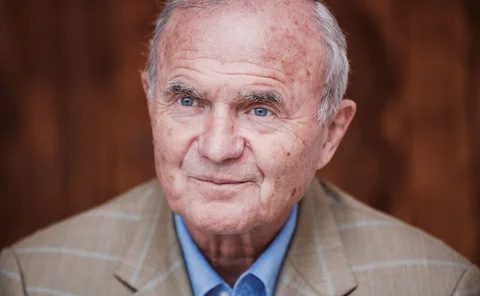

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

IMF report: Kazakh central bank split is opportunity to boost independence

Central bank needs stronger governance and greater separation from government, staff say