Economic and Monetary Union (EMU)

ECB could go below r* when setting policy, says Panetta

Bank of Italy governor says eurozone has to return to “normal way of doing monetary policy”

Monetary unions in the making in Africa

EAC, Ecowas and SADC can adopt practical steps learned from EMU to prepare for their own currency unions

The eurozone’s eastern conundrum

Bulgaria and Croatia expect a net positive effect as they take final steps to join the euro, while the Czech Republic, Hungary and Poland remain reluctant

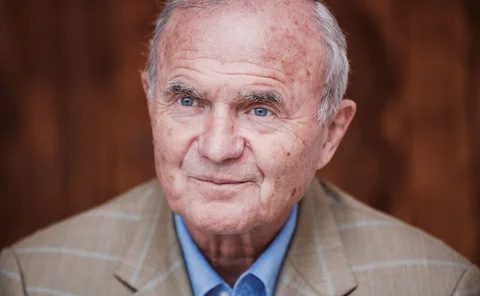

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

West Africa launches new currency in break with France

New ‘eco’ currency will still be pegged to the euro, but France will have less involvement in the affairs of the West African Economic and Monetary Union

Central banking’s 30-year cycle

Central banking has hit another crossroads, writes Central Banking founder Robert Pringle

Reserve requirements an effective tool to balance capital flows – BIS research

Higher interest rates encourage more inflows, but adjustments in reserve requirements can strike a better balance

Book notes: Unfinished business, by Tamim Bayoumi

Anand Sinha praises Bayoumi’s analysis of how the euro crisis and US housing crash were, in fact, intertwined

Income convergence in reverse among original euro members, research says

Fall in income disparities halted soon after 2002 and started to increase after financial crisis

ECB policymakers see a robust economic recovery – minutes

Rate setters satisfied with the impact of the QE extension decided in October

Archive – EMU: a sceptical US view

Allan Meltzer of the American Economic Association explains why he is worried about a union by the back door; first published in November 1997

Book notes: The Limits of the Market, by Paul de Grauwe

De Grauwe has produced a concise analysis into how markets and governments react with one another; but his lack of familiarity with the history of economic thought is surprising

Credit spreads’ limited use as short-term predictors – paper

Researcher examines the accuracy of three sets of credit spreads

Bundesbank’s Buch calls for three-pronged reform effort

Bundesbank vice-president says policymakers should tackle “excessive” risk-taking to prevent further financial crises; evaluating reform is key, says Buch

The ECB must reform Target2 to make it sustainable

Target2 has emerged as the eurozone’s financing entity for ballooning structural balance-of-payments gaps. The present system is unsustainable and needs reform, says Philip Turner

Book notes: Architects of the Euro, edited by Kenneth Dyson and Ivo Maes

This biographical study of the 10 key players in the development of the Economic and Monetary Union provides a contrast to more historical analyses

Netherlands paper exposes differing capital flows across EMU

Paper examines the mechanism behind divergence of north and south eurozone members, as capital flows caused external imbalances to move in opposite directions

Ignazio Visco on Italian banks and why the ECB should not be made a ‘scapegoat’ for EMU fatigue

The Bank of Italy governor speaks to Chris Jeffery about resolving Italy’s NPLs, Europe’s bail-in framework, the importance of QE and why the ECB needs to stop being made a ‘scapegoat’ for EMU fatigue

No ‘insidious’ German plan for EMU competitive advantage, says Issing

Otmar Issing says Germany didn't even have 'the economic intelligence' to design such a plan; country suffered years of high unemployment as others such as Italy failed to capitalise on price stability

Otmar Issing on why the euro ‘house of cards’ is set to collapse

Euro architect tells Chris Jeffery that muddling from one crisis to another cannot go on endlessly. Politicians need to admit “there is no likelihood” of political union to give EMU rules a chance

Euro architect says ECB has ‘destroyed’ market discipline in Europe

Otmar Issing, the man who designed the operational framework for the euro, says failures by European politicians and the ECB mean “all the elements” are in place to bring “disaster” to the monetary union