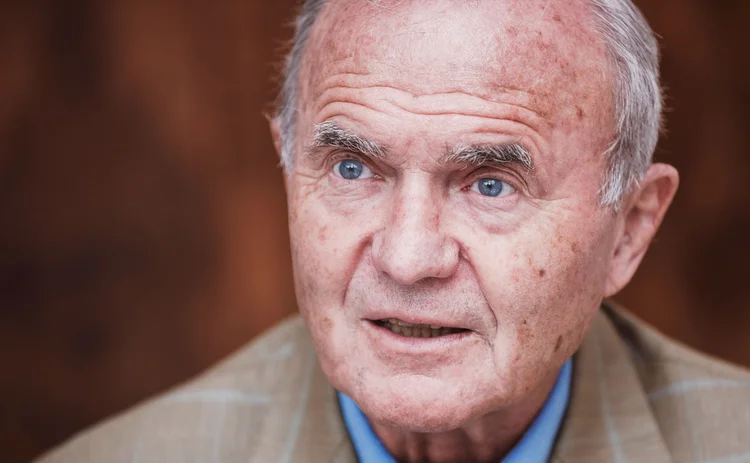

Otmar Issing on why the euro ‘house of cards’ is set to collapse

Euro architect says politicians need to admit there is “no likelihood” of political union

How did you end up designing the architecture that enabled the creation of the euro?

The vast majority of German economists advocated the so-called economists' view that monetary union should be the final step in a long process of European integration. But in 1999, 11 heterogeneous countries embarked on a highly ambitious act towards European Economic and Monetary Union (EMU), despite concerns the euro might fail. As an economist, I shared the German view. But as a central banker (who joined Germany's Deutsche Bundesbank in October 1990), I had to accept this political decision to create a monetary union and to abandon national currencies. The decision was taken unanimously by 11 governments and ratified by 11 parliaments, in some cases accompanied by referendums. The role of the central banks – independent of government or not – is to make the best out of the political decisions. So at the Bundesbank, we prepared for the start of the euro as much as we could. Then I moved to the European Central Bank (ECB) and designed the monetary policy of the ECB.

How did your role change after you left the Bundesbank at the end of May 1998 to become a member of the board at the ECB on June 1, 1998?

I remained in my Frankfurt apartment, but otherwise it was a total change. In May that year, the six ECB board members met in the Eurotower while our offices were still being refurbished. President Wim Duisenberg and vice-president Christian Noyer's offices were to be on the thirty-fifth floor, with the offices for the four others on the thirty-fourth floor. Duisenberg said: "I don't care who gets which office, but Otmar must have one from which he cannot see the Bundesbank." Once they were finished, my office had a wonderful view of the river Mein, so I said: "I cannot accept the method, but I am glad of the outcome."

The ECB and Bundesbank were very different. No longer were people largely from Hesse, but from all over Europe. But it was not difficult for me to adjust. I was now on a European mission, rather than a German one, and I made it very clear that I did not see myself as a German at the ECB, but as person contributing to the success of the euro. For that reason, I refused invitations to speak in Frankfurt during the first three years to demonstrate I was not a Bundesbank person at the ECB, just another board member like the others.

What drew you in, given the obvious dangers? Was it the intellectual challenge, perhaps the moment in history?

It was the greatest challenge facing any central banker. Designing the framework for the monetary policy of a new common currency for 11 countries had never been done before. I was very lucky because Duisenberg not only gave me responsibility for two directorate generals, economics and research – the core of central banking – he also gave me the freedom to do what I thought was appropriate. He trusted me and knew my work. In the first weeks, sometimes tired late in the evenings, I would wonder "Otmar, what are you doing?" because we only started work in June and needed to introduce a new currency by January [1999]. There were so many intellectual preparations as well as unusual challenges. I had written a paper while at the Bundesbank saying a future European central bank should have a monetary target, as it would gain credibility by meeting that – essentially emulating what the Bundesbank had achieved. But at the ECB, my thinking changed, as I realised the risk of adopting a monetary target in a totally changing environment. US economist Robert Lucas did seminal work that determined that when you have a regime shift of any kind, structural relations might change. I wondered if there was any bigger structural change than abandoning national currencies and introducing a new one. Nobody could be sure how savers, investors and financial markets would react.

So what did you do?

So what did you do?

I selected a group of excellent young economists from the economics and research departments, and we entered these uncharted waters trying to do our best. The data situation was terrible. In some cases, there was no access to basic statistics in the 11 countries. There was extreme uncertainty about data and markets. So I told my colleagues, straight off: "You might have read what I said before, but let me be clear: I would be strongly against a monetary target." On the evening of August 8, 1998, it resembled a seminar where we were searching for an answer to a problem. The first issue was that we must come to a conclusion. The second was to be aware that what we designed would have an influence on the lives of 300 million people in Europe. The board and council would have to take the final decision, but I was sure I could convince my colleagues. The team understood that this would have a big impact on people and that we only had one shot. To fail would represent a shock for this new institution from which it would not recover for years to come, and I would have had to resign. So it was exciting, but there was also a weight of responsibility.

What were the data issues?

Some of the unemployment data from different countries had a lag of a year. In some areas, there was no historical data – for example, for car sales in the euro area. This meant we did not know if, for example, two million car sales was above or below the average. In addition, Germans were not very enthusiastic about giving up the Deutschmark. Why should they trust the euro? But an observer from Mars would not have seen anything unusual from the data between December 1998 and January 1999. Nothing happened. There was no shock visible in the data. The success went beyond any expectations, and it upsets me that some believe it was destined to be the case. In October 1998, the council published its strategy for price stability, including a numerical interpretation of what would indicate price stability – to maintain inflation below 2% for the harmonised price index for the euro area. The markets trusted us, a group of fewer than 500 people at the ECB versus 50,000 at the national central banks.

Were there fears that the target of below 2% might have been too low?

Some members viewed it as too ambitious – after all, Germany's track record during the previous 50 years was 2.8%. But the rate at the time of transition was around 1%. The rate was criticised by academics, but accepted by the public and markets. I was convinced that our decision would meet the challenges of the time, and was proven correct. At the same time, we communicated our two-pillar strategy. The results from analysing the development of money and credit were cross-checked with those from an analysis of economic data, including our forecasts for growth and inflation, before making monetary policy decisions. In this respect, we were alone in the world of central banking. But I never understood how a central bank could more or less ignore money and credit. This neglect has contributed to the emergence of a ‘bubble economy' that ended in the great financial crisis in 2008.

You must be frustrated that the euro is area is stumbling from one crisis to another. Why is that?

The 11 countries that joined the euro were heterogeneous. Now there are 19 members: the heterogeneity has increased. The obvious challenge at the start was to continue with the convergence process, which was quite impressive up to the start of the euro, but this was not finished. There was no speed-up of convergence after 1999 – rather, the opposite. From day one, quite a number of countries started working in the wrong direction. For example, it was unthinkable in the early 1990s that Portugal would be part of the first group of countries to join the euro. But Portugal made many reforms. Once it had joined the euro, however, this ambition disappeared. It was the same in many countries, as can be seen by the divergence of unit labour costs. During the first eight years, unit labour costs in Portugal rose by 30% versus Germany. In the past, the escudo would have devalued by 30%, and things more or less would be back to where they were. Quite a few countries – including Ireland, Italy and Greece – behaved as though they could still devalue their currencies. Of course, there is a problem if wages rise by more than productivity. Jean-Claude Trichet, ECB president from 2003–11, repeatedly expressed the dangers of such developments to the Eurogroup. But the politicians didn't listen – and they certainly ignored the advice. So the problem accumulated over time, and only stopped because of the crisis.

Also, as long as member countries remained sovereign states, they needed to abide by the Stability and Growth Pact. But, unfortunately, Germany and France violated the pact in 2003, delivering a fatal blow to the pact from which it has never recovered. Now the European Commission (EC) more or less ignores it. The third development was the boom in construction in Spain and Ireland that was of such a scale that their respective states had to rescue the banks. These political failures had to lead to a crisis that was aggravated by the collapse of financial markets on a global scale.

What was the real driver for European monetary union? Is there any truth to the theory doing the rounds that Germany's leaders gave up German monetary authority and the Bundesbank in exchange for competitive advantage in Europe?

What was the real driver for European monetary union? Is there any truth to the theory doing the rounds that Germany's leaders gave up German monetary authority and the Bundesbank in exchange for competitive advantage in Europe?

The story that this was an intelligent and insidious idea by the Germans to get a competitive advantage in the EMU is one of the strangest ideas I have ever heard. It is ridiculous because what really happened is that Germany entered the euro with an overvalued currency, and it took six or seven difficult years featuring high unemployment in Germany for the country to regain its competitiveness.

Other countries failed to grasp that opportunity, yet now they make Germany a scapegoat for their own failures. Take Italy, for one. It was the candidate that stood to benefit most from joining the euro. By joining the euro, Italians enjoyed the lowest real interest rate they had seen for a very long time. They missed a tremendous opportunity and emerged as the worst performer in growth terms in the euro area. Yet irresponsible politicians have made up this story it was all part of a plan by Germany. Let me be blunt: we wouldn't even have had the economic intelligence to design such a plan. Everyone was concerned Germany would suffer from the monetary union and the loss of the Deutschmark. It was others that hoped to gain stability from a new currency – it was their dream!

What about the theory that Germany did it so it could secure reunification?

I do not think Germany gave up the Deutschmark in return for reunification – although this hypothesis is not out of the realms of possibility. One has to understand chancellor Helmut Kohl [in power from 1982–98] was convinced that the final step to integrate Germany into Europe was a single currency. His views were strongly influenced by his experiences of World War II and the death of his brother, and he did not trust the future behaviour of Germans. The move was deeply unpopular in Germany. But Kohl took this risk – and I had some discussions with him on this – that Germany needed to be irrevocably bound to Europe. The plans for monetary union existed before the collapse of the Berlin Wall. In my view, the fall of the wall was a coincidence, but German unification certainly fostered the willingness of Germans to go in this direction. Thank you for letting me put the record straight regarding these poisonous rumours that irresponsible people have spread.

The ECB is trying to maintain price stability, and governments should do their best to ensure solid public finances. There is no need to think about being a counterpart to a finance ministry. If politicians had done their job, there would be no talk of conflict between fiscal and monetary policies

Is it legitimate to have an independent supra-national central bank absent a single government with fiscal authority?

When the Maastricht Treaty was discussed and the statute for the future ECB was debated, a few strands came together. One was that during the 1980s, an increasing number of studies showed that the degree of price stability coincided with the independence of the central bank. So the mood for independence was supported. In Europe, the Bundesbank was independent, and it was known as such around the world. By acting independently, it had helped to ensure monetary stability in Germany since the creation of the Deutschmark in 1948. A combination of empirical evidence and an insistence by Germans resulted in an independent ECB at a time when no other national central bank had independence – I recall Margaret Thatcher, [the UK prime minister from 1979–90], stating the Bundesbank "was the best central bank in the world", and I explained that much of its reputation was because of its independence. And I asked her why she didn't give independence to the Bank of England (BoE). She replied: "That is a different issue." Not having a European finance minister was never a problem. The ECB is trying to maintain price stability, and governments should do their best to ensure solid public finances. There is no need to think about being a counterpart to a finance ministry. If politicians had done their job, there would be no talk of conflict between fiscal and monetary policies.

Was it a mistake to allow a voting structure of ‘one person, one vote', given the shareholding structure of the ECB, so creating a vast discrepancy between voting power and financial liability?

When former BoE governor Robin Leigh-Pemberton, [in the role from 1983–93], was asked by Thatcher why he subscribed to the Maastricht Treaty, he told her: "Because Karl Otto Pöhl subscribes to it." Pöhl, [Bundesbank president from 1980–91], was seen as the final arbiter. I had a few discussions with Pöhl on this. Initially, he found it bizarre that the president of the Bundesbank should have the same voting right as the governor of the Central Bank of Luxembourg. But, increasingly, he warmed to the idea that the governors of national central banks sitting on the governing council should be there as individuals making European decisions.

At the first council meeting of the ECB in 1998, the national central bank governors sat behind plaques with representations of their nations. Bundesbank president [from 1993–99] Hans Tietmeyer protested. "We are not representatives of our countries," he said. From then on, council members have always had plaques bearing only their surnames. On the other hand, the more the council decides on measures that have immediate implications for individual countries and the closer the policies are to fiscal policy, the more difficult it is for a person to separate their national interests from European interests. It is not so much a problem with the voting, it is more to do with where the ECB policy has strayed. But even in the current situation, weighted votes would not have helped, as those with an interest in more lax policies can always arrange for a majority. All it would do is instil a national element in the governing council that would creep into all decisions.

If nationality does not matter, why are there so many Germans and French nationals in senior position?

If nationality does not matter, why are there so many Germans and French nationals in senior position?

Nationality must not matter. The best qualified should be promoted – that is the principle that must be respected.

Was it a mistake to give banking supervisory powers to the ECB?

I was a member of the de Larosière group that presented the 2009 Report on financial supervision in the EU that was pretty much fully subscribed to by the European Commission and the European Council. There were two main recommendations. One was to establish a macro-supervisory authority, with central banks playing a major role. The other was for a system of banking supervisors to be set up. We warned strongly against making the ECB responsible for banking supervision, as we were concerned about conflicts with monetary policy and interactions with politics when it comes to rescuing individual banks – as, ultimately, rescues involve taxpayer money, rather than central bank money. This brings the central bank unavoidably into contact and conflict with national fiscal policy. So we argued in favour of an independent European banking supervisory authority. But for that there was a need for a change in the treaty. We showed a way that this could possibly be achieved. But politicians felt it was almost unthinkable to get a treaty change. So they mandated the ECB with supervision. Now the warnings in our report are coming to the fore. Conflicts with monetary policy and the problems in Italy to implement a new resolution mechanism demonstrate that our concerns were justified.

What specific issues are showing up in Italy?

The ECB is taking decisions on collateral, but at the same time it is the banking supervisor. How can you separate monetary policy from effort that supports the weak banks to ensure they survive? The decline in the quality of eligible collateral is a grave problem. The ECB is now buying corporate bonds that are close to junk, and the haircuts can barely deal with a one-notch credit downgrade. The reputational risk of such actions by a central bank would have been unthinkable in the past. Too big or too connected to fail is the main source of moral hazard behaviour of banks. Taxpayer money should not be used any more to save banks – this was one of the central lessons from the financial crisis. How convincing is the new regime if this lesson is ignored?

Former BoE governor Mervyn King has devised what he terms a "pawnbroker for all seasons" approach, where bank collateral is pre-positioned in good times, so if there is a crisis, banks can immediately draw on that liquidity from central banks. This implies the acceptance of lower forms of collateral. Is his thinking flawed, too?

Former BoE governor Mervyn King has devised what he terms a "pawnbroker for all seasons" approach, where bank collateral is pre-positioned in good times, so if there is a crisis, banks can immediately draw on that liquidity from central banks. This implies the acceptance of lower forms of collateral. Is his thinking flawed, too?

King's The end of alchemy: money, banking and the future of the global economy is a brilliant book, and his lender-of-last-resort proposal gets to the core of the problem: to identify the conditions in normal times and not to be exposed to the dynamics of the crisis when many principles will be violated because of political pressure with financial actors ultimately expecting to be bailed out. King wants to do away with this. The aim is to set the conditions prior to any crisis that will be preserved during times of crisis. It is a brilliant proposal, although the details need to be worked out. When banks know in advance the conditions they will face in a crisis, the dynamics will change and the moral hazard aspect is addressed. At present in Europe, we see weak banks still paying dividends all the time. They are not using profits to recapitalise, as they are betting that ultimately they will be bailed out, should they fail.

What do you make of efforts for common liabilities related to deposit insurance across Europe?

The banking union has three segments: common supervision; resolution, which is being debated; and deposit insurance. There is strong resistance in Germany to shared deposit insurance. The reason is that German banks have saved large amounts of funds – although admittedly not sufficient to address a full-scale crisis – for deposit protection. In some other countries, not only are no deposit insurance schemes in place, but these countries face major legacy banking problems. If national funds were pooled and those funds used to address legacy problems, it would exploit German savers. So you can only start such a regime when the Euro area's banks are all in a solid condition and have common supervision. It was a strange idea to suggest legacy funds should be used to address past mistakes by others.

Are you in favour of a new deposit insurance scheme?

Initially, I was convinced it was a good idea. But I am becoming increasingly concerned and suspicious. A deposit scheme needs to be fair, so contributions should be made relative to the riskiness of a bank's business. But the introduction of a risk-adjusted scheme does not seem likely, and implementation would be extremely difficult. If you think of it in insurance terms, the amount you pay for fire insurance protection depends on a number of risk factors. No insurance company offers contracts to everybody on the same terms. A flat fee immediately creates a moral hazard problem.

What is your view on quantitative easing (QE) and outright monetary transactions (OMTs)? Is there a big legal distinction between the two?

After the successful first years, the positive effects of QE are more or less fading. Meanwhile, the negative side effects are increasing. However, QE in my view is legal and a legitimate policy. OMT is very different because "to do whatever it takes" involves troubled countries getting support from the ECB. The ECB selectively buying bonds of such countries – which must agree to a reform programme – is very alien to monetary policy. The direction of OMT is selective buying of government bonds, and this is a transgression by the ECB into monetary financing – as it is the intention to buy bonds of country x and not of country y, and it destroys the market control mechanism. When long-term interest rates in government bonds before the crisis had pretty much converged, it was seen as success. Yet we now know it was the source of problems because if a country such as Greece or Italy is paying interest rates more or less the same as France, Germany, Luxembourg, the Netherlands and Finland, it is not because markets believe in the same solidity of public finance. It is because they know the ECB will come in and support those bonds. The idea of installing a politically controlled mechanism on the fiscal policy of member states via the Stability and Growth Pact has more or less failed. Market discipline is done away with by interventions by the ECB. So there is no fiscal control mechanism from markets or politics. This has all the elements to bring disaster for monetary union.

Why weren't markets punishing countries before the crisis?

I have spoken to many bankers about this. It seemed to be a combination of herd behaviour combined with nobody really believing the ‘no bail-out' principle would be observed in a crisis. There was a belief the ECB would come in. And now of course, the ECB is heavily invested in these bonds whose spreads are artificially low, meaning an exit from QE policy is more and more difficult, as the consequences potentially could be disastrous.

Were you surprised by the European Court of Justice's (ECJ) endorsement of OMTs?

I wasn't surprised, as the ECJ seems to have a simple, straightforward European orientation. But I am very concerned by the decision – especially the justification for it. It was anything but a convincing argument.

Are you worried that formally independent operators such as governments, the ECB, European Stability Mechanism and banks are factually interdependent in the Euro area?

The former US Federal Reserve vice-chairman Alan Blinder has commented that central banks did not become independent of politics only to become dependent on markets. The ECB and the Fed try to do everything so as not to upset markets. This is an implicit dependence on market developments. Of course, central banks should not deliberately distort markets – but, equally, they should not make their decisions based on a likely immediate market reaction. Yet this seems to be happening increasingly often. The combination of this, the overburdening by supervision and a substitute for fiscal policies, unavoidably raises the question about whether this power can be given to an independent central bank. So the independence of central banks is under threat. And more decisions by central banks have intended distributional effects for which they have no mandate and where they are not exposed to the voting process. While politicians are happy the ECB is the only game in town at the moment, over time they will start asking why an independent central bank has such power. At the Bundesbank, we only believed we could act as an independent actor if we had the narrow mandate of maintaining price stability and maintaining the value of the currency. Anything beyond that creates a conflict with independence.

The former US Federal Reserve vice-chairman Alan Blinder has commented that central banks did not become independent of politics only to become dependent on markets. The ECB and the Fed try to do everything so as not to upset markets. This is an implicit dependence on market developments. Of course, central banks should not deliberately distort markets – but, equally, they should not make their decisions based on a likely immediate market reaction. Yet this seems to be happening increasingly often. The combination of this, the overburdening by supervision and a substitute for fiscal policies, unavoidably raises the question about whether this power can be given to an independent central bank. So the independence of central banks is under threat. And more decisions by central banks have intended distributional effects for which they have no mandate and where they are not exposed to the voting process. While politicians are happy the ECB is the only game in town at the moment, over time they will start asking why an independent central bank has such power. At the Bundesbank, we only believed we could act as an independent actor if we had the narrow mandate of maintaining price stability and maintaining the value of the currency. Anything beyond that creates a conflict with independence.

But is it harder in Europe with no finance ministry?

[US economist] Allan Meltzer has demonstrated that in some periods, the monetary policy of the Fed was de facto under fiscal dominance. If a central bank violates the idea of independence, it will undermine the legitimacy of independence.

It will be a case of muddling through, struggling from one crisis to the next one. It is difficult to forecast how long this will continue for, but it cannot go on endlessly. Governments will pile up more debt – and then one day, the house of cards will collapse

But surely the ECB doesn't really have any choice?

At present, it would be impossible to ask the ECB to totally change its course. But the current situation has emerged as part of a slippery slope that the ECB has been drawn down, making it ‘the only game in town'. There is no easy way for it to get out. And the exit will become increasingly difficult, while at the same time the ECB is undermining its role as an independent central bank. Take the May 2010 decision [about the Greek debt crisis]. It was clear over the weekend that if nothing happened by Monday, there might be turmoil in financial markets. It was obvious Greece could not meet its payments. Finance ministers were unable to deliver a solution. So the ECB was put in a lose-lose situation. By not intervening in the market, the ECB was at risk of being held responsible for a market collapse. But by intervening, it would violate its mandate by selectively buying government bonds – its actions would be a substitute for fiscal policy. The ECB had respectable arguments to intervene. But it turned out that the "ECB had crossed the Rubicon". Of course, Julius Caesar had to go on and conquer Rome. But there was no need for the ECB to say that in the future in the same situation, it would act in a similar manner. It could have been made clear that this was a once-only event and would never happen again. Otherwise, it is a slippery road.

How long can everything keep going before something gives? The politicians do not want to take action – not dismissing some of the austerity in countries where International Monetary Fund involvement has taken place. Nobody with a surplus really wants to share fiscal burdens. So what happens next?

Realistically, it will be a case of muddling through, struggling from one crisis to the next one. It is difficult to forecast how long this will continue for, but it cannot go on endlessly. Governments will pile up more debt – and then one day, the house of cards will collapse.

Can't something be done?

Politicians are constrained by election processes and so on. But what is missing is a common understanding that the European Union is a community of sovereign states with a common monetary authority, the ECB. The key element of national sovereignty – fiscal policy – lies with individual states. And this institutional arrangement will continue for some time. There is no likelihood of political union in the near future. So a monetary union with fiscal sovereignty of member states can only continue if there is a no bail-out clause. Today, the no bail-out clause is violated every day, de facto. I would not expect the ECB to say: "From now on, nations must be compliant with the rules." But the direction should be towards adhering to the rules.

However, there are still many politicians stating there will be a mutualisation of debt with political union coming later – so the moral hazard is overwhelming. If politicians could clarify this political debate – which never occurs, despite all the summits in Brussels – to unite and say that political union is a vision at best, and stop giving the impression that political union is around the corner, it would create the opportunity to move in a direction where the no bail-out clause is taken seriously. The reason this doesn't happen is not just due to time limitations caused by the refugee crises, etc. It is because politicians in some countries are aware they would be destroyed politically at home. But it is the lack of clarity on the future direction that is the problem.

Could the eurozone's challenges be resolved by parallel currencies?

Could the eurozone's challenges be resolved by parallel currencies?

The EU has EMU members and non-members. Within the monetary union, the idea so far is that it is one speed. My preference would have been that when the Greek crisis first came to the fore – and it was obvious its debt situation was unsustainable – no more financial support would have been granted to Greece, and the country would have had to leave the euro. After that, the EU would then offer all the support it could to Greece to help its economy recover and ensure in the longer term that it could meet the criteria relevant for it to rejoin the euro from a much stronger position. What initially took place was that a bail-out occurred that saved the banking system – and mainly stopped French and German banks from incurring losses in Greek bonds. It created a situation with all the wrong incentives. It would have been better to demonstrate a country could leave the euro and rejoin from a much stronger position later. Such an event would have clarified that being a member of the ‘euro club' can only come by meeting the club's economic rules. But this opportunity was missed.

Is it too late now?

It is an option that still exists, but could only occur in an emergency situation. One of the problems with the construction of the EMU from the beginning was that once a member, you remain a member. Adhering to this philosophy creates an instant moral hazard problem. It is like being a member of a non-smoking club and some people suddenly start to smoke. You either have to eject the smokers or change the rules of the club.

How would you assess the IMF's role?

I was in favour of IMF involvement. But I was very concerned when the ECB became a member of the troika. I understand the ECB should be interested in knowing what is going on and to contribute by formulating conditions, etc. But, on the other hand, it is my understanding – probably very simple and naïve – that it is not appropriate for an independent central bank to be part of such a political process. I expected the IMF to give much more priority to the rules than the EC – the EC is highly politicised and even its experts are under political pressure. But the IMF conducts many reform programmes around the world, its staff are technically competent and are not easily intimidated. I expected the IMF to talk to the Europeans about what was needed as a neutral, objective institution. With its strong reputation and location far away in Washington, DC, I expected it to resist pressure from the Greek government. This involvement now seems to have come to an end.

King views the euro as a spanner in the works for solving global imbalances, as Europe's currencies cannot move any more as they should because of EMU. Why don't you agree?

Firstly, verifying imbalances is difficult. Moreover, zero balances are not optimal. An ageing country and shrinking economy like Germany should have a current account surplus – no doubt about it. There is a need to build up external assets that later can contribute to pensions requirements. The other issue is current account imbalances within the euro area versus global imbalances. Both Mervyn and I believe Europe and Germany can help to reduce imbalances by doing structural reforms, liberalising the labour market and fostering growth. Many American economists argue that Germany should run a fiscal deficit. There is no theory that would support that a country with a positive output gap, more or less full employment, extremely expansionary monetary policy – much more so than the country needs – and, from a national perspective, a weak exchange rate should also pursue a fiscal deficit. There is a need for additional infrastructure investment in Germany, but this should come from restructuring expenditure from consumption to investment, not by running a fiscal deficit. It is not my intention to defend German economic policy, but the solution to Germany's problem is not fiscal deficits. And it would not really help our neighbours either, as the fiscal multiplier for other countries is so small – it would destroy the equilibrium in Germany for no real benefit to other countries.

Where does the Bundesbank go from here? It has spoken out against many of these issues, but has been ignored.

The role of the Bundesbank is underestimated, as president Jens Weidmann typically is seen as isolated. This is not the case. Behind the scenes, a number of other national central banks are supportive of the views of the Bundesbank. And without resistance from the Bundesbank, the slippages would have occurred faster and gone further. One should not underestimate that. Having a voice is important, even if it does not result in an overall vote. The governing council was always a place where arguments counted, not the size of your country. In this context, arguments matter. And ECB president Mario Draghi and Weidmann agree on quite a lot of things, too. The Bundesbank has confirmed it views QE as legal, but that it should not be extended in dimension and time. On the ECB governing council, it is simply not the case that it is everybody versus the Bundesbank.

Images: Mario Schmitt; Annabel Jeffery

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: http://subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com