Barry Eichengreen

China needs dollar reserves to bolster renminbi – Eichengreen

Authorities must reassure global markets to make renminbi reserve currency, paper argues

How Turkey’s president created chaos in economic policy-making

Observers allege presidential domination of the central bank, unauthorised FX transactions and untrustworthy statistics

China’s capital controls: here to stay?

With China’s share of the domestic central government bond market significantly increasing in just a few years, and the International Monetary Fund including the renminbi in its special drawing rights basket of currencies, China is enjoying growing…

IMF research highlights limits of exchange rate flexibility

New dataset sheds light on role of dominant-currency invoicing for exchange rate dynamics

Why has the euro failed as a global reserve currency?

ECB's Klöckers says fragmented capital markets and incomplete banking union holding euro back; while sovereign crisis and low yields contributed to 'underperformance' as a reserve currency, survey finds

Stress levels rising: investment funds and the Covid-19 shock

Extreme market stresses due to Covid-19 are underscoring the central role non-banks play in crisis contagion, as in 2008. Were regulators better prepared this time?

Macro-prudential analysis is not fit for task – leading economists

Carney and Honohan warn of fund failures and Hélène Rey calls for better risk indicators

Banks ‘still groping toward’ macro-pru transparency – Eichengreen

Central bank governance expert says central bank transparency is getting better around the world, although New Zealand, Argentina and some Central American institutions could make improvements

Hysteresis can explain eurozone peculiarities – Eichengreen and Bayoumi

Eurozone has not responded to shocks in the way economic theory would normally imply, with the German economy tied surprisingly closely to those of ‘peripheral’ countries

Eichengreen sees danger in US fiscal stimulus

Veteran economist warns infrastructure spending in the US may prove damaging to both the domestic and global economy, without necessarily fixing secular stagnation

Fibre optics raise concentration of forex trading - paper

Barry Eichengreen and co-authors find technological gains from submarine fibre optic cables helped increase the concentration of foreign exchange trading

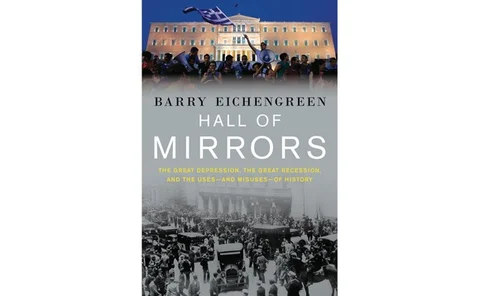

Book notes: Hall of mirrors, by Barry Eichengreen

A scholarly, but readable narrative that interleaves an account of the build-up to and course of the Great Depression with the similar course of events in the Global Financial Crisis

Will new reforms lift the veil of secrecy at the Bank of England?

The Bank of England has unveiled a broad package of reforms to its transparency. Daniel Hinge speaks with transparency experts to assess the changes

Eichengreen says central banks should worry more about deflation than 'profits and losses'

The Berkeley professor on what last week's SNB move says about big central banks 'wrong-footing' markets and the Fed's problematic response to financial crisis

Bank of England unveils sweeping transparency changes

Bank of England to publish transcripts of monetary policy meetings, cut number of meetings, revamp committee structures and more; Barry Eichengreen says benefits likely to ‘dominate’ costs

End of Bretton Woods has helped dollar reserves, says ECB paper

The collapse of the Bretton Woods System has resulted in significant upheaval of currency reserve trends, says an ECB working paper co-authored by Barry Eichengreen

Sveriges Riksbank overhauls communication strategy

Sweden's central bank will focus on ‘dialogue' to better explain its operations; 'openness and clarity' remain guiding principles for the bank, which regularly tops transparency rankings

Central banks are getting more transparent, study finds

Study conducted by Barry Eichengreen and Nergiz Dincer finds trend towards greater transparency was not knocked off course by the financial crisis; independence, however, is more patchy

Fiscal stimulus crucial for recovery

Centre for Economic Policy Research (CEPR) compares the Great Depression with the global credit crisis

Bleak new outlook from Eichengreen and O'Rourke

Respected economists still find few green shoots

Rethinking decoupling

The decoupling hypothesis has been one of the casualties of the crisis, Martina Horáková argues