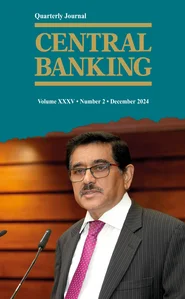

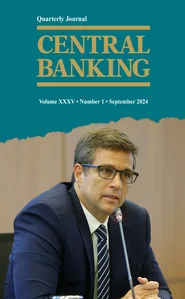

Central Banking Journal - Volume XXXV Number 2

Articles in this issue

Central banking amid uncertainty and Trump 2.0

Deglobalisation set to challenge the central banking orthodoxy of the past 40 years

People: October to December 2024

A round-up of central bankers in the news and on the move

Banknotes: October to December 2024

A round-up of news and salient issues that have affected central bankers in the past three months

Nandalal Weerasinghe on Sri Lanka’s IMF programme, central bank reforms and road to recovery

The Central Bank of Sri Lanka governor speaks about his return from retirement to aid Sri Lanka’s structural reforms and recapitalisation, reinforce central bank independence and develop financial resilience

How (not) to review your monetary policy framework

The Fed made some mistakes in its last strategy review. As it prepares to have another go, it could learn from other central banks

The Fed can afford to loosen policy

As (nearly) the world’s most hawkish central bank, the Federal Reserve is right to start monetary loosening, writes Steve Kamin

Suspended Bulgarian deputy claims he is fighting for central bank ‘independence’

Eurozone candidate country’s deputy breaks silence on suspension, and his fight to get reinstated

The hidden dynamics behind China’s BoP ‘errors and omissions’

Marcello Minenna highlights the possible implications an unaccounted-for £30bn has for the PBoC

Mamo Mihretu on the radical reform of central banking in Ethiopia

Ethiopian governor speaks about simultaneous monetary policy and exchange rate reform, opening the country’s financial system and a fundamental reset for Africa’s second most populous economy

Greedflation, if it ever existed, is correcting itself

Steve Kamin constructs a “wage gap” to assess inflationary pressures in the US

How to increase the impact of financial literacy initiatives

As surveys show financial literacy outcomes falling short, Pedro Duarte Neves distils key lessons

The past and future of BIS economics

The monetary and economic department has become an influential force in central bank economics. Claudio Borio looks back over 37 years at the institution and Hyun Song Shin looks to the future

Securing sound deposit protection in East Africa

There is a need to revisit legal frameworks to adopt risk-adjusted premium regimes and establish more comprehensive deposit insurance systems in the East African Community, write Gilbert Nyatanyi and Gloria Tengera

Malaysia’s Zeti on the key skills needed to be a successful central banker

The Bank Negara veteran speaks about leadership skills, lessons from the AFC and 1MDB crises, her scepticism of inflation targeting, and how the Asia School of Business' masters synthesises theory with practical realities

Crashing the nth party: how third-party service provider risks compound

Cross-border collaboration may help deal with risks from multiple layers of outsourcing

Portraits on banknotes: a study of the gender gap

Only Australia’s currency has gender parity; overall, less than 10% of portraited banknotes – excluding Elizabeth II – feature female images

Demand for cash: a global update

Antti Heinonen explores recent data on banknote demand and analyses its impact on cash infrastructure

Book notes: Money in the 21st century: cheap, mobile, and digital, by Richard Holden

Author’s call for compulsory end of cash and transition to CBDC seems like ‘overkill’

Book notes: The monetarists: the making of the Chicago monetary tradition, 1927-1960, by George S Tavlas

A fascinating, scholarly and sympathetic account of the Chicago monetary tradition

Book notes: Carbon colonialism: how rich countries export climate breakdown, by Laurie Parsons

Compulsory reading to gain insights into many climate issues that receive insufficient ‘airtime’

Book notes: The road to freedom: economics and the good society, Joseph E Stiglitz

A stimulating amalgamation of previous ideas presenting the kind of economic system most conducive to decent society