Feature

The ECB, the lockdown and the monetary financing lock

The eurozone’s central bank may need to break its prohibition on monetary financing to fight the pandemic

Fed set to adopt ‘elements’ of price-level targeting

Covid-19 could act as a catalyst for a Janet Yellen-supported Fed move to adopt elements of price-level targeting. But questions remain about the timing of such a move

The IFF China Report 2020

Insight and perspectives from the world's leaders, premier policy-makers and financiers

The Central Bank Digital Currency Survey 2020 – debunking some myths

Most central banks believe there are retail uses for central bank digital currencies, but few plan to launch a CBDC in the coming five years, with most rejecting the use of blockchain

The IFF China Report 2020: Regional and multilateral co-operation

The Belt and Road Initiative has expanded to corners of the globe never thought possible; investment in Latin America, Africa and the Caribbean has strengthened free trade and fostered positive development. But there is still work to be done to ensure a…

Debts, deficits, central banks and inflation

Forrest Capie and Geoffrey Wood ask what insights history can provide for central banks and governments managing abrupt, large increases in debt

The IFF China Report 2020: Green finance and fintech

Green finance has been steadily growing over the past few years. As China has come under greater scrutiny about the scope of its projects, the Belt and Road Initiative has evolved to foster sustainability both in terms of debt servicing and…

The IFF China Report 2020: The Belt and Road Initiative

Over the past six years, China has invested more than $500 billion in the Belt and Road Initiative (BRI) – of which there are now in excess of 150 participating counties and organisations. Leading Chinese and international policy-makers explain how BRI…

The Belt and Road Initiative 2020 Survey – A more sustainable road to growth?

The third annual Belt and Road Initiative (BRI) survey reveals that central banks view BRI investment as sustainable compared with other forms of external debt, particularly given it is often proportionally less significant. Despite growing global trade…

The IFF China Report 2020: China’s opening-up

Extending from east to west, China’s Belt and Road Initiative now encompasses as much as 65% of the world’s countries and a significant portion of global GDP. When first announced, investment was primarily targeted at transport infrastructure – but this…

Transfer season

Trade frictions with the US have caused a mass industrial transfer to China’s neighbours. Zhou Chengjun, IFF Academic Committee member and inspector of the Macro‑prudential Policy Bureau of the People’s Bank of China, says that shouldn’t stop China…

Should the Fed be next to implement yield curve control?

The Reserve Bank of Australia is now the second G20 central bank trying to control longer-term interest rates. Could the Fed be next?

The IFF China Report 2020: Financial stability

When US President Donald Trump introduced tariffs on Chinese exports in 2018 it upset the world order and dampened economic growth. China responded in force, asking its firms to find alternative sellers for US exports. As a result, it has bought…

The long march to global growth

Liang Tao, vice-chairman of the China Banking and Insurance Regulatory Commission, says that China’s growth is fuelling innovation and modernisation, but financial regulation and governance needs to be tightened up for China to take its place at the top…

Some thoughts on CBDC operations in China

People’s Bank of China deputy governor Fan Yifei outlines why he favours an indirect approach to introducing a CBDC in China

The Tokyo Olympics: downside risks prevail

The Bank of Japan’s latest stimulus effort seems to be weak, and comes at a time when the benefits of hosting the Tokyo Olympics may be overstated – even if the games still take place

Central banks and banks: a changed relationship

The development of large, complex international capital markets has reshaped the relationship between central banks and their commercial counterparts

FedNow: the advantage of going last

While the Fed is late in developing instant payments, it can learn about fraud detection, interconnectivity and directory services strategies from Europe, the UK and Australia

Do low rates spur investment?

Many believe low interest rates spur investment, but there appears to be little hard evidence to support such claims, writes former IMF head Jacques de Larosière

Why Bulgaria needs to deepen its currency board

The BNB’s currency board rules should be extended to transaction deposits at commercial banks, which could in turn issue digital currencies, even in the event of euro adoption

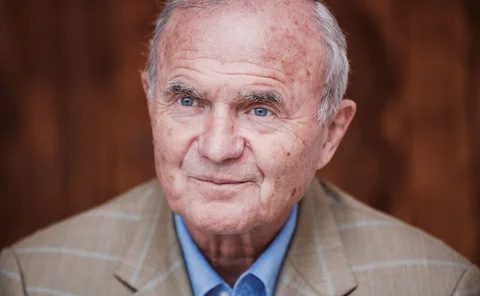

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

Specialised lending initiative: BNP Paribas

A new ‘global’ setup helped secure US dollar-denominated assets from a Eurosystem central bank

Transparency: Reserve Bank of New Zealand

Publication of new MPC handbook and minutes increases RBNZ’s openness

Communications initiative: Bank of Jamaica

The Bank of Jamaica broke the mould with its reggae-inspired communications strategy, but observers suggest it has done more than just lift the economic literacy of its society