Playing fair – Unlocking the horns of China and the US

The unprecedented explosion of global prosperity in the 70 years since the end of World War II owes much to the continuing liberalisation of international commercial activities that has fostered ever-closer integration of national economies into the global economy.

The primary inspiration for the creation of a global economic community – spurred by eight rounds of trade liberalisation under the General Agreement on Tariffs and Trade, and associated reductions in the barriers to international flows – has been the US. Undoubtedly, the US has been a major beneficiary of the system it has worked assiduously to create, but virtually every country – not least China – has benefited in equal or greater measure.

It is with dismay and deep concern that I view the current situation, in which the US administration appears to have determined the arrangements for international commerce are unfair to the US. To redress what is perceived as an imbalance of benefits from trade, the US has discarded its prior commitment to inclusive negotiations to effect freer trade in favour of crude protectionism designed to advance efforts to negotiate favourable bilateral deals.

The US has abandoned the proposed Trans-Pacific Partnership; rejected the North American Free Trade Agreement, which has been relabelled with minor changes as the United States–Mexico–Canada Agreement; withdrawn its support from the World Trade Organization (WTO); and unilaterally imposed tariffs on imports from long-term allies and trading partners.

While all of this has been unfolding, President Xi Jinping has emerged as the champion of continuing globalisation; he and other senior leaders have promoted regional trade agreements and the Belt and Road Initiative, and repeatedly assured other countries of China’s commitment to further ‘opening-up’. Actions are yet to match the promises that have been made, but recent statements – made at the China International Import Expo, and by the Association of Southeast Asian Nations and Asia-Pacific Economic Cooperation – could presage important breakthroughs to come.

Escaping the impasse

One concern for an outside observer is to identify a way out of the current trade dispute between the world’s two largest trading powers – China and the US (see figures 1 and 2).

The ultimate objectives of the US actions are unclear; how will we know that the US is satisfied with the resolution, however it is reached?

Concerns the US has about China include:

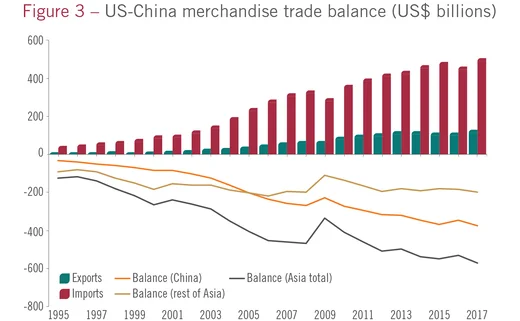

- China’s bilateral trade surplus – possibly a result of currency manipulation (see figure 3).

- A lack of access to Chinese markets for goods, services and investment opportunities. In addition, US companies face onerous conditions for investment in China: ownership restrictions, and restricted access to technology and intellectual property. The issue here seems to be asymmetric treatment.

- Theft of intellectual property, including state-sponsored attempts to steal commercial secrets. Attention was paid recently to perceived efforts to acquire information about the latest advances in information technology.

- The favoured position enjoyed by Chinese state-owned enterprises that precludes fair competition.

- The objectives of ‘Made in China 2025’ – China’s industrial policy to upgrade the quality of products and services in manufacturing by 2025.

Objective assessment would acknowledge the US has legitimate grievances in these areas, but surely alternative approaches should be preferred to resolve them. The Trump administration’s heavy-handed trade policies seem as misguided as they are uninformed.

What is most worrying is that the US will not be satisfied until China eliminates, or significantly reduces, its bilateral surplus – a peculiar obsession of President Donald Trump – and abandons, or modifies in unspecified ways, the goals of Made in China 2025.

China could probably reduce its surplus with the US by opening up further to US products – a process that would be boosted by US willingness to sell what China wants to buy. But, unless the US adjusts its domestic investment to align more closely to domestic savings, any reduction in China’s surplus will emerge as an increase in the surpluses – or reduction in deficits – of other countries with the US.

The second obstacle is potentially insoluble: China is unlikely to abandon its longer-term economic goals just because they annoy the US. Not enough is known about what China intends to even endorse the proposed policies for Made in China 2025.

Beyond the damage done by the current trade standoff, prospects for substantially expanded investment flows between the US to China that were encouraged by negotiations towards a bilateral investment treaty (BIT) now seem remote. Volumes of direct investment that the world’s largest economies have made in each other are almost unbelievably small compared with their similar investments elsewhere; the interests of both countries would be well served by a major increase in two-way investment flows. China talks about opening up to more foreign direct investment (FDI), but without necessarily including US companies. Meanwhile, the Committee on Foreign Investment in the US is considering an expanded mandate to restrict foreign investment that is deemed a risk to national security.

In this difficult environment, a wise path for China is to continue active support for global economic integration, including by continuing to open up – if possible, more aggressively. Ideally, China could:

- Keep the door open to the US on trade issues.

- Support the WTO and refer disputes to it for arbitration.

- Foster regional trade agreements, but seek inclusive agreements where possible.

- Continue to allow markets to determine the renminbi exchange rate.

- Seek supply deals with non-US sources.

- Continue – more determinedly – to open the domestic economy to FDI where some promises are unfulfilled: sectors would include finance, energy and communications.

- Pursue the prospect of a BIT with the European Union and others. But extend concessions made to US firms as well –

- a conciliatory gesture to the US, but very much in China’s own interests.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: http://subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com