Fed's Tarullo sees few signs of illiquidity in OTC markets

Fed governor says markets are in transition

A top Federal Reserve official has dismissed claims that liquidity is evaporating in over-the-counter derivatives markets.

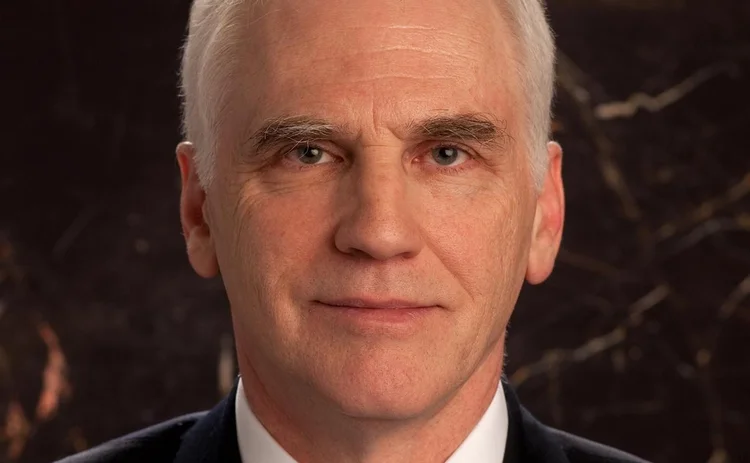

Daniel Tarullo, a member of the Board of Governors of the Federal Reserve System, said he does not see a problem with illiquidity in swaps and fixed-income markets.

"You don't see much evidence in spreads of big changes or illiquidity," Tarullo said at an Institute of International Finance conference in New York earlier today (June 4).

However, Tarullo did acknowledge that

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: http://subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@centralbanking.com