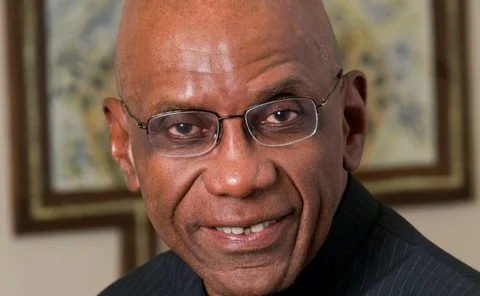

Daniel Hinge

Editor, Benchmarking

Daniel Hinge is editor of Central Banking’s benchmarking service and subject specialist for economics and monetary policy. He has reported on the central banking community since 2012, in roles including news editor and comment editor. He holds a degree in politics, philosophy and economics from the University of Oxford.

Follow Daniel

Articles by Daniel Hinge

US thrashes out partial solution to fiscal cliff

US government reaches agreement that postpones and reduces fiscal cliff; measures unlikely to have significant impact on Fed policy, some observers say

Central Bank of Nigeria denies Sanusi arrest warrant rumours

Central bank says no arrest warrant for Sanusi Lamido Sanusi issued – contrary to local media reports – but admits governor has defied parliamentary summons

BoE to get new FMI supervision department

Bank of England will gain new powers of oversight over financial market infrastructures after transition from Financial Services Authority in April next year

BoE and FDIC co-operate on bail-in plans

US deposit insurer and UK central bank release plans for resolution of global systemically important banks, focusing on a ‘top-down’ approach to maintain viability long enough for restructuring

UK’s Wheatley outlines behavioural foundations of FCA approach

CEO-designate of UK’s Financial Conduct Authority says regulator’s new approach will centre on behavioural economics rather than treating consumers as fully rational

Bank of Greece upbeat on recovery prospects

Interim 2012 report on monetary policy says ‘tangible’ progress has been made in key sectors, but commentators warn optimism may be unfounded

Carney gets Bank of England top job

Mark Carney, currently governor of the Bank of Canada, will take over from Mervyn King to run the UK central bank in June 2013, despite earlier appearing to deny interest in role

Mersch appointed to ECB amid continuing controversy

Appointment to ECB board finalised despite challenge over lack of female candidates; Sharon Bowles says democracy has been shown to be discarded when ‘its truths are inconvenient’

New UK regulators may have some overlap, says FSA’s Nicoll

Director of conduct policy at UK’s FSA says there may be crossover between ‘twin peaks’ regulators; report suggests banking lobby can influence rule-making and industry complacent over costs

FSB takes next steps towards shadow banking regulation

Financial Stability Board gives recommendations for regulating financial institutions outside the regular banking system; estimates shadow banking sector reached $67 trillion in 2011

BoJ mirrors BoE’s FLS and steps up easing

Bank of Japan launches scheme with similarities to Bank of England’s funding for lending and steps up the size of its asset purchase programme by $138 billion

Bundesbank reveals specific location details of gold holdings

New details of the Bundesbank’s foreign gold holdings released as Bank of Italy admits also not physically verifying gold held overseas despite having world’s third largest gold reserves

Bank of Finland’s Honkapohja gets second five-year term

Seppo Honkapohja reappointed for a second five-year term on the board of the Bank of Finland; only three board members of a possible six currently in office

Bundesbank under pressure over $172bn gold inventory

German Federal Court of Auditors calls on Bundesbank to check gold held at Federal Reserve, Bank of England and Banque de France; Bundesbank to move 150 tonnes back to Germany over next three years

Third-quarter figures show Spain still grappling with economic woes

Bank of Spain economic bulletin for the third quarter shows continued weakening of growth and range of other economic indicators; raises possibility government will not meet deficit target this year

Central bankers highlight merits of fixed exchange rate regimes

Bosnian and Barbadian governors discuss the importance of a fixed exchange rate for small and open economies

EU leaders agree on new powers for ECB

European Central Bank to run single supervisory mechanism, but leaders fail to agree on when bailout funds can be directly injected into European banks

Volcker warns of ‘permeable’ Vickers ring fence

Paul Volcker tells a UK parliamentary committee the Vickers ring fence has loopholes that will be widened over time by banks; says bad culture in trading arms ‘infected’ retail banks

BoE’s Tucker says FCA may have to intervene to correct accounting failures

Paul Tucker says difference in market and banks’ asset valuations may require intervention by the Financial Conduct Authority; praises bail-ins as method of imposing discipline

Final rules for D-Sibs published as FSB holds plenary meeting

Financial Stability Board meeting in Tokyo endorses publication of final framework for regulating D-Sibs; principles focus on assessment methodology and higher loss-absorbency requirements

ECB chief views speed of reform as critical for success

ECB chief Mario Draghi calls for the fast implementation of single supervisory mechanism despite many details remaining unclear; others say reform needs to be more ‘thought out’

Iranian central bank struggles to support plummeting rial

‘Foreign exchange centre’ set up by Central Bank of Iran to regulate exchange rate as rial falls sharply in value; fears emerge that currency free-fall could cause hyperinflation

Hungarian government abandons central bank transaction tax

Hungary’s minister for the national economy says transaction tax will not be applied to central bank following pressure from European authorities and the IMF

Bank of Greece abandons 9% core capital requirement

Central bank suspends plans to raise core Tier I capital ratio as banks struggle to raise equity and data show contraction in lending continues