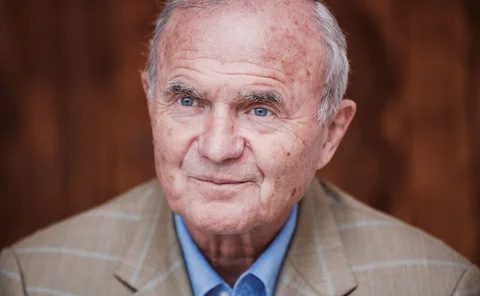

Paul Volcker

The predicament of bloated central bank balance sheets

Swollen balance sheets carry significant risks for combating inflation, ensuring financial stability and preserving central bank credibility, independence and effectiveness. How can central banks reduce them?

A return of the inflation monster?

There are fears that a shift in intellectual approach towards running economies ‘hot’ could herald a return of the money-eating inflation era

Olli Rehn on AIT, market neutrality and EU fiscal policies

The Bank of Finland governor talks about the ECB’s strategy review, market failure on climate change, lessons from the sovereign debt crisis, and the Draghi legacy effect on Covid-19 responses

Fears rise over breakdown in Basel and IFRS standards

Bretton Woods institutions worried about growing divergence in capital and accounting standards as credit impairment tsunami looms; US and many emerging economies skirting the rules

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

2019: The year in review

The past year was marked by a persistent weakening of the global economy, and some radical financial innovations

Tribute to a great man

Peter Bakstansky highlights Paul Volcker’s legacy of probity and integrity

Paul Volcker, 1927–2019

The Fed chair made his name battling inflation, and left his mark on independence and post-crisis financial regulations

Atlanta Fed publishes 1,300-page history of the Fed

Document reveals early concerns Fed creation would lead to politics in banking or banking in politics

Book notes: Economics for the common good, by Jean Tirole

The book should be well received amid the recent rise in populism

Central banking’s 30-year cycle

Central banking has hit another crossroads, writes Central Banking founder Robert Pringle

IMF’s Adrian on the big tech threat and why a ‘non-system’ works

The IMF’s financial counsellor speaks about risks from big tech’s move into fintech, the fund’s efforts to craft well-targeted policy guidance and why the current international monetary ‘non-system’ works

Former Fed chairs stress importance of central bank independence

President Donald Trump has repeatedly criticised chair Jerome Powell for keeping interest rates too high

‘They could do nothing’: insights into political interference at the Fed

Interviews with former Fed chiefs reveal what it is like to be chair when politicians want their way

Former Fed chairs join over 3,000 economists in call for carbon tax

Economists including central bankers and Nobel laureates demand action on climate change

Book notes: Keeping at it, by Paul Volcker with Christine Harper

Volcker, a man who has made history, delivers a fascinating memoir, providing insights into the key lessons learned during his decades of public service, writes Jean-Claude Trichet

Fed proposes lightening regulations for large banks

Lael Brainard objects to plans, warning they could leave taxpayers “on the hook”

Fed and other US regulators call for major changes to Volcker rule

Complex legislation has created compliance uncertainty, Federal Reserve argues

FOMC members rarely change their preferences – paper

Researchers find policymakers tend to form their preferences early on in life

Book notes: Hole in the Wall, by James Shepherd-Barron

Cash machines have changed the way cash is managed, but is there a future for such machines in a world looking to go cashless?

Stanley Fischer announces October resignation from Fed

Vice-chair to step down in October “for personal reasons”, eight months before scheduled