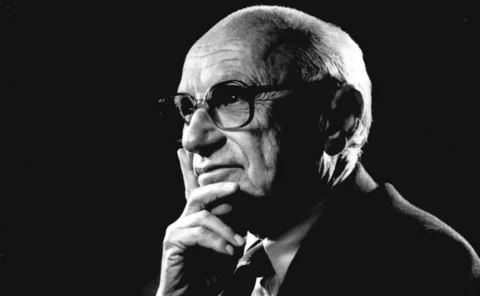

Milton Friedman

CNB’s Aleš Michl on tackling inflation, Friedman’s legacy and ditching DSGE

Czech governor speaks about policy mistakes, targeting M2, diversifying into equities and gold, and ending interest on minimum reserves

Book notes: The Federal Reserve: a new history, by Robert L Hetzel

This book should become the standard reference for scholars

Book notes: A monetary and fiscal history of the United States, 1961–2021, by Alan Blinder

The book’s breakthrough is its infusion of the history of fiscal policy into a theoretical framework traditionally focused on monetary instruments. It is a splendid and thrilling read

Book notes: Yellen, by Jon Hilsenrath

This book offers new insights into the tough decisions and tremendous efforts Yellen has made as a pre-eminent economic policy-maker

The case for restoring the role of monetary aggregates

Tim Congdon argues that a surge in money supply in response to Covid-19 sparked heightened inflation and central banks need to refocus their attention on monetary aggregates

Book notes: Harry White and the American creed, by James Boughton

This book offers a deeper understanding of the hugely influential IMF founder and his work, but fails to resolve espionage charges

Book notes: Imagining the Fed, by Nicolas Thompson

A worthwhile perspective on the evolution of such an important institution, but a shame that it isn’t a longer and broader examination

Book notes: Empire of silver, by Jin Xu

A useful introduction to China’s monetary history, focusing on the last 1,000 years, but not the easiest of reads throughout

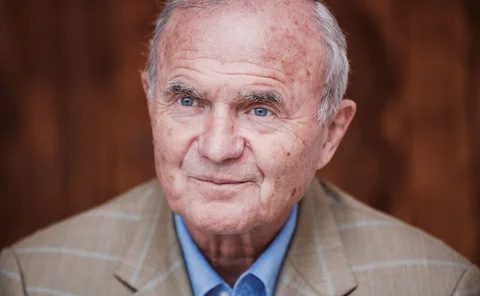

Charles Goodhart on inflation targets, financial stability and the role of money

The LSE professor says inflation targets should have been 0%, the Fed’s move to AIT is a mistake, independence is under threat from inflation, big balance sheets support liquidity, AI can help supervisors and climate stress tests are unconvincing

‘Run it hot’: the risks and rewards of a new policy era

Covid-19 has added impetus to an emerging intellectual shift in policy-making. But central banks face unresolved issues – on expectations, on fiscal policy, and on the capacity of the economy to ‘run hot’

Book notes: Austerity, by Alberto Alesina, Carlo Favero and Francesco Giavazzi

When it works and when it doesn’t; every chapter is thorough, informative and persuasive

High US inflation should not be ruled out

A prolonged health crisis raises the risk that supply-side factors, monetary expansion and rising personal savings could stoke hidden inflationary pressures

The ECB, the lockdown and the monetary financing lock

The eurozone’s central bank may need to break its prohibition on monetary financing to fight the pandemic

Inflation targets back in the spotlight

Monetary policy can do little to offset the impact of Covid-19

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

Macroeconomics is not broken

The discipline has moved beyond the neoclassical synthesis. Critics should too

Central banking’s 30-year cycle

Central banking has hit another crossroads, writes Central Banking founder Robert Pringle

The IFF China Report 2019

Insight and perspectives from the world's leaders, premier policy-makers and financiers

The IFF China Report 2019: Financial deepening, fintech development and green financing

The past 40 years have seen China transform from a recipient of global aid to a major economic centre in its own right. China is now seeking to deepen its markets, gradually open its borders to global financial flows, and promote new and innovative forms…

Book notes: Where economics went wrong, by David Colander and Craig Freedman

Chicago economics’ gladiatorial debating style has cost the discipline dearly, the authors argue

Oxford academic argues Milton Friedman is misunderstood

James Forder says Friedman had a bigger impact on neoclassical economics than on monetarism