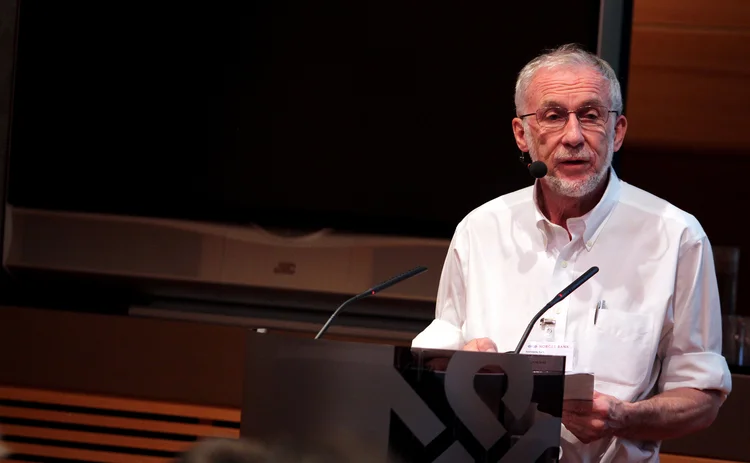

Svensson says house price metrics ‘unreliable and misleading’

Former Riksbank deputy governor says authorities are misjudging risks

House prices may not be as overvalued as they seem and could even be undervalued, due to the use of “unreliable and misleading” indicators, Lars Svensson argues in new research.

In the working paper, Svensson, a professor of economics at the Stockholm School of Economics, criticises the widespread use of price-to-income (PTI) and price-to-rent ratios, which he says are “unreliable and misleading”.

“These indicators disregard the crucial role of interest rates and other costs of owner-occupied

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: http://subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com