RBI bolsters liquidity framework with standing facility

New deposit facility will play a role in both monetary and financial stability

The Reserve Bank of India has set up a new standing deposit facility (SDF), in a move it says will strengthen its monetary policy and add a new line of defence for financial stability.

The central bank unveiled the facility on April 8 at its regular monetary policy meeting. Policy-makers kept the main rate on hold at 4% and introduced the new deposit facility as the floor underneath the policy rate, at 3.75%. Previously, a reverse repo facility played a similar role.

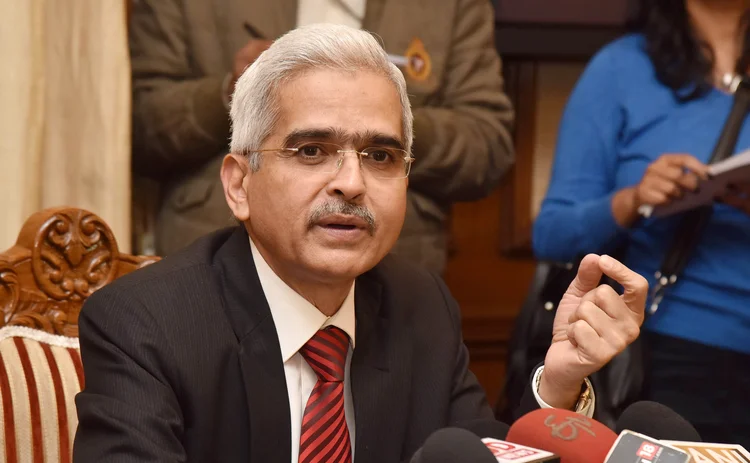

Central bank governor

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: http://subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com