Turkey’s Dornbusch moment

Turkey’s new deposit scheme sets the stage for hyperinflation, writes Barry Eichengreen

The late, great Massachusetts Institute of Technology economist Rudi Dornbusch is remembered for many things, but none more so than his quip about economic dynamics: “In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could.” This neatly encapsulates the situation in Turkey. Some of us have been forecasting a crisis for two years. (I plead guilty.) Now it’s arrived, and with a vengeance.

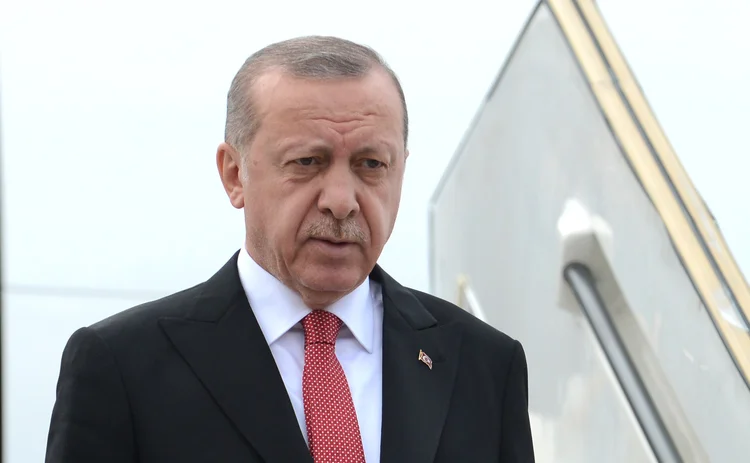

The roots go way back. Turkey’s official statistics, for what they are worth, show a period of “high-quality” economic growth before the global financial crisis, when the economy leapt ahead in response to newly installed president Recep Tayyip Erdoğan’s reforms. This was then followed by a period of “low-quality” growth, when productivity stagnated and the economy’s expansion was sustained by state-sponsored infrastructure investments and cheap bank credit.

Those official statistics should be taken with a mountain of salt. My own research, with Nergiz Dinçer and Ayça Tekin-Koru, reconstructs Turkish productivity growth using firm-level data. We show that the productivity malaise set in earlier. Output per worker was being dragged down already in the early 2000s by government subsidies, artificial incentives and cheap credit that induced a shift of resources into low-productivity construction, real estate and business services (for business services, read: landscapers and security guards).

An economy can’t expand indefinitely on this basis, as Thailand discovered in 1997, and Ireland, Spain and the US learned a decade later. The chickens had already come home to roost before Covid-19. Turkish GDP growth had already fallen to less than 1% in 2019, reflecting subsidies and cheap credit for construction, rampant corruption, and pervasive policy uncertainty. The only question, following Dornbusch, is why the crisis took so long to materialise.

The answer is that Turkey tranquilised foreign investors with high interest rates, which sufficed to attract them until they did not. The wake-up call, of course, was Erdoğan’s disastrous low-interest-rate policy. Economists can construct models in which higher interest rates are inflationary, as Erdoğan argues they are. But, then, economists can construct models of anything. For a country with a sizeable current-account deficit, interest-rate cuts that discourage foreign investors are a recipe for currency depreciation and inflation, which are just what Turkey has seen.

And now comes Erdoğan’s deposit guarantee. Banks will continue to set their own deposit rates, presumably in the neighbourhood of the policy interest rate, which currently stands at 14%. If inflation exceeds this level, then the Treasury will make up the difference, keeping intact the purchasing power of lira deposits. The scheme applies to retail depositors who lock up their lira for three, six, nine and 12 months.

Some of us have been forecasting a crisis in Turkey for two years. (I plead guilty.) Now it’s arrived, and with a vengeance

This is a recipe for not merely inflation, but hyperinflation. Hyperinflation, of course, has two ingredients. First, money creation that fuels inflation. Second, and critically, inflation that fuels money creation. Erdoğan’s deposit guarantee adds this second element. The Turkish Treasury is not going to be able to sell bonds to finance its deposit scheme. It will have to rely on central bank credit.

Thus, unless inflation immediately comes down from the November rate of 21%, or the putative December rate of 30%, all the way to 14% (the level around which banks are setting their deposit rates), and unless it stays there, the Treasury and central bank will be on the hook. Additional credit creation will cause inflation to head back up.

Although there are alternatives to the high-inflation scenario, none is happy. The central bank can intervene in the foreign exchange market with the goal of subduing inflation and restoring confidence. But it has done so already. To finance those interventions, it has borrowed dollars from the commercial banks, to the point where the central bank’s net reserves are already negative. So, intervention can’t go on without bankrupting the banks (if they’re not paid back) or further fuelling inflation (if they’re paid back in depreciated lira).

Alternatively, Turkey can impose exchange controls to limit capital flight and lira depreciation. But this will precipitate a recession in an economy that depends on foreign capital to finance a current account deficit. The government can impose limits on deposit withdrawals, but this would have a disastrous impact on confidence.

Finally, Erdoğan can reverse course and allow the central bank to go about its business – that business being to raise interest rates. But this would be an embarrassing climbdown for a politician who has painted himself firmly into the low-interest-rate corner. Erdoğan is likely to go to whatever lengths are required to avoid such embarrassment, with an election coming in the next 18 months.

The only solution is restarting economic growth. Erdoğan was happy with a policy that implied a weaker lira because a Turkish economy suffering from non-existent productivity growth required the competitive advantage of a low exchange rate. He insisted on low interest rates because the construction and manufacturing sectors could stay afloat only with cheap credit. The medicine worked: it just killed the patient.

Reducing subsidies for construction, eliminating distortive regional preferences, rooting out corruption, and reducing economic policy uncertainty could allow the Turkish economy to begin growing again without such artificial support – and without runaway inflation.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: http://subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com