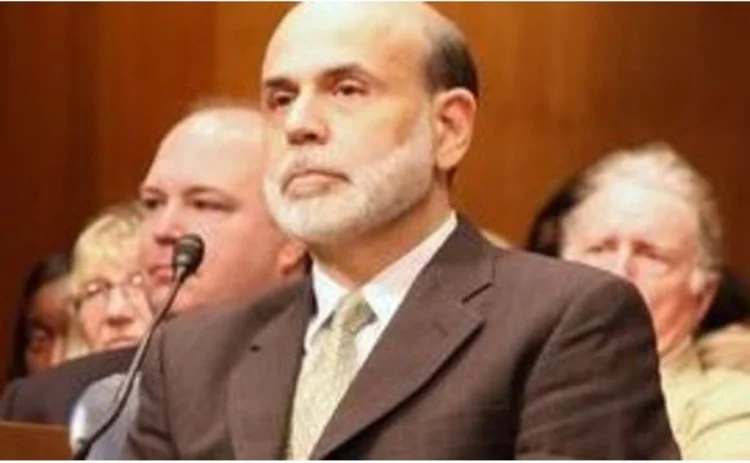

Bernanke: low rates didn’t spur housing bubble

Ben Bernanke, the chairman of the Federal Reserve, on Sunday blamed regulatory, not monetary, laxness for the housing bubble.

Critics have sought to blame the Fed for the financial crisis, claiming too-low interest rates set to spur growth in the aftermath of the bursting of the dotcom bubble caused the credit crunch. However, Bernanke disputed this, arguing that the federal funds rate was in line with the Taylor Rule for monetary policy - the standard means to test the suitability of rates for

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: http://subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com