Currency innovation: Giesecke+Devrient Currency App

German company has helped central banks improve educational outreach to bolster national currency security

Mobile phones have helped increase financial inclusion to some of the most unbanked populations across the globe. Now, central banks are using smart versions of these devices in another fashion: to enhance the security of a nation’s currency.

While banknote security providers continue to search for the latest security features – developing new threads, holograms and foils – the overall integrity of currency in circulation hinges upon the knowledge and understanding of the wider population. Giesecke+Devrient (G+D) has striven to help central banks in this regard.

The German company, well known in the industry for its forward-thinking technology development, has designed new currency app technology that it can utilise to offer bespoke services for central banks. “The Currency App is definitely a modern approach for the education of the population on security features,” says Hans Heusmann, vice-president for G+D Currency Technology.

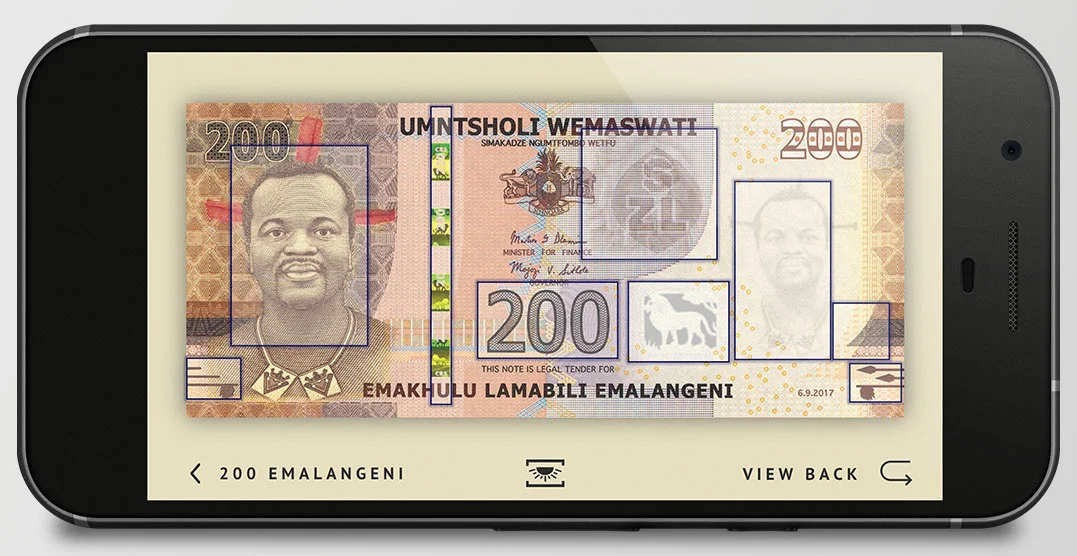

G+D’s app connects to the smartphone’s gyro sensor and animates optically dynamic security features, such as Spark and RollingStar, synchronising with the movement of the device.

“We tried to focus on the interactivity of the app with the end-user,” says Heusmann. “As a result, the pictures of these security features react to movement like the features in real banknotes.”

The technology also integrates links to the social media of the central bank, which allows the different central bank communication channels to interconnect.

The success of the application is evident in the expanding number of central banks adopting the technology. The Central Bank of Eswatini (formerly Swaziland) was G+D’s first app client, developing its Lilangeni app in April 2018.

Produced in both English and Siswati, the app allows users to identify the security features of currently circulated banknotes, and explains how they can be verified. The app also has a currency converter element, an explainer on what notes are circulated and remain legal tender, plus links to the central bank’s YouTube account.

Customer-driven

In June 2018, the Bank of Thailand launched an app in collaboration with G+D, with the aim of reducing the number of counterfeit banknotes. “This has been an effective educational tool for us – more effective than the tools we have used in the past,” says Sopee Sa-nguandekul, director of the banknote strategic planning department. “We had been talking about an app for a long time. The mobile phone has become a part of everyone’s life.”

The Bank of Thailand was in the process of deciding to develop a banknote app when G+D, which also provides the substrate and sorting machines for the central bank’s banknote series, provided what Sa-nguandekul describes as the “perfect solution”.

“We were happy with what they produced for us,” she says. “They worked hard on the app, and listened to our feedback during the creative phase.”

This has been an effective educational tool for us – more effective than the tools we have used in the past

Sopee Sa-nguandekul, Bank of Thailand

During the creation of the app, G+D went back and forth with the Bank of Thailand to ensure the layout of the app was in line with the target audience. “We did change some of the aspects of the app based on what we thought the public would want. G+D went back and made some changes, and came back with a new proposal that fitted what we wanted,” says Sa-nguandekul.

Each security feature on the note is identified to help members of the public understand whether banknotes have been counterfeited. “In areas where micro-letters are used in the offset, the screen will react if touched with a finger and display a loupe function, allowing a detailed view of the background print,” explains G+D’s Heusmann. “Moving the finger over intaglio will result in a vibration of the phone simulating the rough surface of an intaglio print.”

In addition to information on security features, the app also has the ability to send counterfeit alerts and provide information about cash use to members of the public. “This is the first banknote app we have had in Thailand, and it has helped both members of the public and commercial banks understand what we are doing in the currency space,” says the Bank of Thailand’s Sa-nguandekul.

While she does not believe the app will reduce the number of counterfeit notes, she does believe it will prevent the public from continuing to accept the false notes: “The intention for the application is to promote public knowledge on security features and how to detect the counterfeit ones.”

New reality

Three additional central banks are also working with G+D to develop new apps that are due to be released in 2019. Not content to stand still, the company has been using research to understand what new technological elements can be added to the existing software to make the app more compelling to end-users.

“Multiple studies on the smartphone app market show that consumers’ interest can be further increased together with the overall download rate by including gaming opportunities, and virtual and augmented reality elements,” says Bruno Garoffolo, a senior marketing executive at G+D.

Next year, G+D will launch a new app with a central bank, combining its existing software with augmented reality.

“Once the camera of the smartphone identifies a certain banknote denomination, it will start to modify the artwork of the banknote, and integrate buildings and avatars on the smartphone screen,” explains Heusmann. “It’s a kind of storytelling, adapted to the culture and content of the respective country, which should draw attention and boost interest in the app.”

The Central Banking Awards were written by Christopher Jeffery, Daniel Hinge, Dan Hardie, Rachael King, Victor Mendez-Barreira, Joel Clark, William Towning and Tristan Carlyle

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: http://subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com