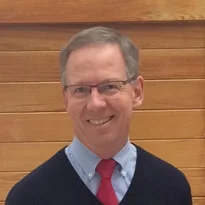

Michael Reddell

Michael Reddell spent most of his career at the Reserve Bank of New Zealand, where he was heavily involved with monetary policy formulation, and in financial markets and financial regulatory policy, serving for a time as Head of Financial Markets. He also spent time at the New Zealand Treasury, as alternative executive director on the board of the IMF, and as a resident economic adviser to the central banks of Papua New Guinea and Zambia. These days, semi-retired, he writes a blog on central banking, economic performance and productivity, and related issues (with a New Zealand focus), and serves on the board of the Bank of Papua New Guinea.

Michael is a reviewer for Central Banking, writing regularly for the ‘Book notes’ section of the quarterly journal.

Follow Michael

Articles by Michael Reddell

Book notes: Money in the 21st century: cheap, mobile, and digital, by Richard Holden

Author’s call for compulsory end of cash and transition to CBDC seems like ‘overkill’

Book notes: Going infinite: the rise and fall of a new tycoon, by Michael Lewis

Nothing in the book left this reader thinking anything positive at all about Bankman-Fried

Book notes: We need to talk about inflation, by Stephen King

A short, sensible book that highlights key issues – and might make a good, belated Christmas gift!

Book notes: Inflation targeting and central banks, by Joanna Niedźwiedzińska

A useful and rich reference source, especially for central banks moving to adopt inflation targeting

Book notes: States and the masters of capital, by Quentin Bruneau

Chronicling the practices and players involved in privately financed sovereign debt

Book notes: Money and the rule of law, by Peter Boettke, Alexander Salter and Daniel Smith

A largely US-focused book, which hankers for more robust rules for central banks but isn’t explicit as to what kind

Book notes: Global discord, by Paul Tucker

A curious mix of a book, which attempts to think through how democracies should deal with the rise of Communist China

Book notes: Two hundred years of muddling through, by Duncan Weldon

Insights into UK economic history offer lessons for today’s policy-makers

Book notes: Imagining the Fed, by Nicolas Thompson

A worthwhile perspective on the evolution of such an important institution, but a shame that it isn’t a longer and broader examination

Book notes: Empire of silver, by Jin Xu

A useful introduction to China’s monetary history, focusing on the last 1,000 years, but not the easiest of reads throughout

Book notes: The pay off, by Gottfried Leibbrandt and Natasha de Terán

A timely introduction to and accessible survey of payment system developments

Book notes: Quantitative easing, by Jonathan Ashworth

Well-documented and fairly comprehensive book for anyone, including central bankers, wanting an overview of how monetary policy has evolved in recent decades

Book notes: The political economy of the special relationship, by Jeremy Green

Unsatisfactory story about the decline and resurgence of the UK’s importance in the global financial system

Book notes: Central banking before 1800, by Ulrich Bindseil

A new standard reference point for the history of central banking

Book notes: Why not default?, by Jerome Roos

A thought-provoking book that will repay the investment of any reader with an interest in sovereign debt

Book notes: Floored!, by George Selgin

Michael Reddell remains unconvinced the Fed’s introduction of the IOR prolonged the recession, but credits Selgin’s argument the IOR policy made the central bank a more powerful credit lender

Book notes: The Fed and Lehman Brothers, by Laurence Ball

Ball claims the Fed could have lent to Lehmans, lawfully and prudently, had it chosen to do so, writes Reddell. But agreeing the Fed could have provided liquidity support does not automatically imply it should have

Book notes: Capitalism without capital, by Jonathan Haskel and Stian Westlake

The authors have created a compelling framework to characterise and explain the nature of intangible investments in our economies, writes Michael Reddell, but their conclusions are lacking in analysis and data

Book notes: Unelected power, by Paul Tucker

Tucker’s well-argued text sets out a set of principles for those in unelected positions of power to ensure they continue to act for the benefit of the general public, but Reddell says it is a shame more attention is not paid to smaller central banks

Book notes: The paradox of vulnerability, by John Campbell and John Hall

Quality of national institutions vital to handling financial crises, say authors

Book notes: Money in the Great Recession, by Tim Congdon

A stimulating collection of papers on the monetarist theory that had central bankers in late 2008 focused on boosting the quantity of broad money “the Great Recession would not have happened”

Book notes: The Tides of Capital, by Julia Leung

This “stimulating read” offers a unique perspective on how Asian countries have developed economically over the past 20 years. More interesting is Leung’s unintentional revelation that they still have a long way to go

Book notes: Bankers, Bureaucrats and Central Bank Politics, by Christopher Adolph

An interesting, if slightly dated, analysis of those who made monetary policy decisions in advanced economies between 1950–2001, attempting to understand whether personal background influences decision-making

Book notes: The power and independence of the Federal Reserve, by Peter Conti-Brown

Conti-Brown offers a call to action to fix the legitimacy of the Federal Reserve System, which is looking increasingly dated