Central banks increasingly embracing the cloud

Forms of cloud computing are becoming more prevalent, despite central banks’ caution

Central banks have been steadily adopting forms of cloud computing in aspects of their work, and the use of such tools is now prevalent among institutions.

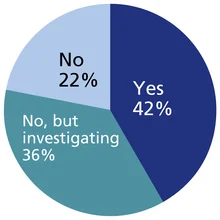

Central Banking’s 2019 big data survey, published today (November 4), shows 42% of respondents are using the cloud in at least some aspect of their work. A further 36% said they were investigating possible future use of the cloud, and only 22% said they had no plans to use cloud services.

A total of 58 central banks responded to this year’s survey, with 69% from emerging or developing countries and 31% from advanced economies.

The cloud allows users to tap into on-demand services, which are run from servers that may be on the other side of the planet. The advantage is the ability to scale computing power as needed, as well as the provision of specialist services, such as artificial intelligence tools.

The downside is that the cloud can throw up issues of data privacy and security. Central bankers tend to say they are only willing to use the cloud for the less sensitive parts of their work, such as research projects conducted in secure environments.

Many respondents to this year’s survey said their use of the cloud was relatively narrow – one said it was used solely for IT security, while another said it was used only in a handful of projects within the HR department.

The cloud can be useful for research. One respondent from a large central bank said they had been able to solve “huge matrices” by combining the Linux operating system and Fortran programming language with computing power from the cloud.

“[The cloud] allows us to get faster answers compared [with] the Windows platforms, such as Matlab, that we have in the bank,” this Latin American central banker said. “However, we do not upload any confidential or microdata.”

Another large central bank in the Americas said it was in the process of implementing a “private cloud service”. In Europe, there was work under way on the feasibility of a supranational cloud for data sharing. Other governments, such as those in New Zealand and Canada, have similarly signalled their support for the cloud.

The use of cloud services is relatively new, and Central Banking only asked about them in one previous survey. In 2017, just 14% of respondents said they used the cloud for external data storage. As one Asian central banker noted at the time: “Internal regulations restrict the use of external cloud resources.”

Privately, some big data specialists have told Central Banking their use of the cloud is restricted due to caution from senior managers – the possibility of a data breach or sensitive data being used by an unscrupulous technology company are serious concerns for central banks.

Government-operated clouds might alleviate some of these issues. But local laws on data protection are also limiting central banks’ options. The 2019 survey shows 58% of central banks find themselves impacted by legal or ethical issues around data.

Of particular note is Europe’s General Data Protection Regulation (GDPR), and many other countries have implemented similar national initiatives. “GDPR and the laws related to privacy sometimes limit or exclude the possibility of gathering more granular data, which would be extremely helpful for policy purposes,” lamented one European central banker.

Data that could identify individuals must be handled especially carefully, noted one central banker from Oceania: “Administrative data that matches employers and employees poses risks in terms of identifying specific individuals and businesses. It is challenging to develop the right infrastructure to minimise these risks and to create a social licence so that the general public understands the benefits of such data in allowing for better government policy evaluation.”

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: http://subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com